14

Nov

AI Forex Robot V2.0 MT4 NO DLL: True AI Trading for MT4 & MT5 Without Headaches

Ever feel like AI trading promises are just marketing fluff wrapped around the same old indicators? You're not alone. Most "AI" forex robots are glorified moving average crossovers with fancy names. But the AI Forex Robot V2.0 MT4 NO DLL breaks this mold by delivering genuine machine learning capabilities without the technical headaches that usually come with advanced trading systems.

The biggest frustration with sophisticated EAs isn't their complexity, it's the installation nightmares. DLL dependencies, compatibility issues, security warnings, and constant troubleshooting that eat into your trading time. This robot eliminates all of that while maintaining the advanced AI features you actually want.

What Makes This EA Different from Standard Trading Bots

The AI Forex Robot V2.0 operates as a fully automated trading system with built-in artificial intelligence and comprehensive risk management, all without requiring external DLL files. This isn't just another grid or martingale system disguised with AI branding, it's engineered with self-learning algorithms that analyze market data and optimize trading parameters continuously.

The core innovation lies in its signal engine architecture. Rather than relying on static technical indicators, the system processes multiple market variables through neural networks that adapt to changing market conditions. This means the robot doesn't just follow predetermined rules, it evolves its trading approach based on performance feedback and market behavior patterns.

Advanced Signal Processing Without External Dependencies

Traditional AI trading systems often require external libraries or DLL files to handle complex calculations. These dependencies create security vulnerabilities and compatibility issues across different broker environments. The V2.0 eliminates this entirely by incorporating all AI processing directly within the MetaTrader framework.

The signal engine combines multiple analytical approaches:

- Trend Recognition: Machine learning algorithms identify emerging trends before they become obvious to conventional indicators

- Mean Reversion Detection: AI models spot oversold/overbought conditions with higher accuracy than standard oscillators

- Volume Analysis: Advanced volume profiling integrated with price action for institutional-level market reading

- Sentiment Integration: Real-time market sentiment analysis factored into trade decisions

Technical Specifications and Platform Compatibility

The robot functions seamlessly across both MT4 and MT5 platforms, automatically adjusting its interface and execution methods based on your platform version. This dual compatibility ensures you won't face limitations regardless of your broker's platform preferences.

Key technical features include:

Risk Management Engine: Built-in position sizing algorithms that automatically calculate optimal trade sizes based on account equity, volatility, and risk parameters. The system can limit daily drawdown, maximum simultaneous positions, and exposure per currency pair.

Adaptive Timeframe Analysis: The AI processes data across multiple timeframes simultaneously, from M1 to D1, creating a comprehensive market view that informs trade timing and direction.

News Event Filtering: Integrated economic calendar awareness that can pause trading during high-impact news events, preventing the erratic market movements that often destroy automated strategies.

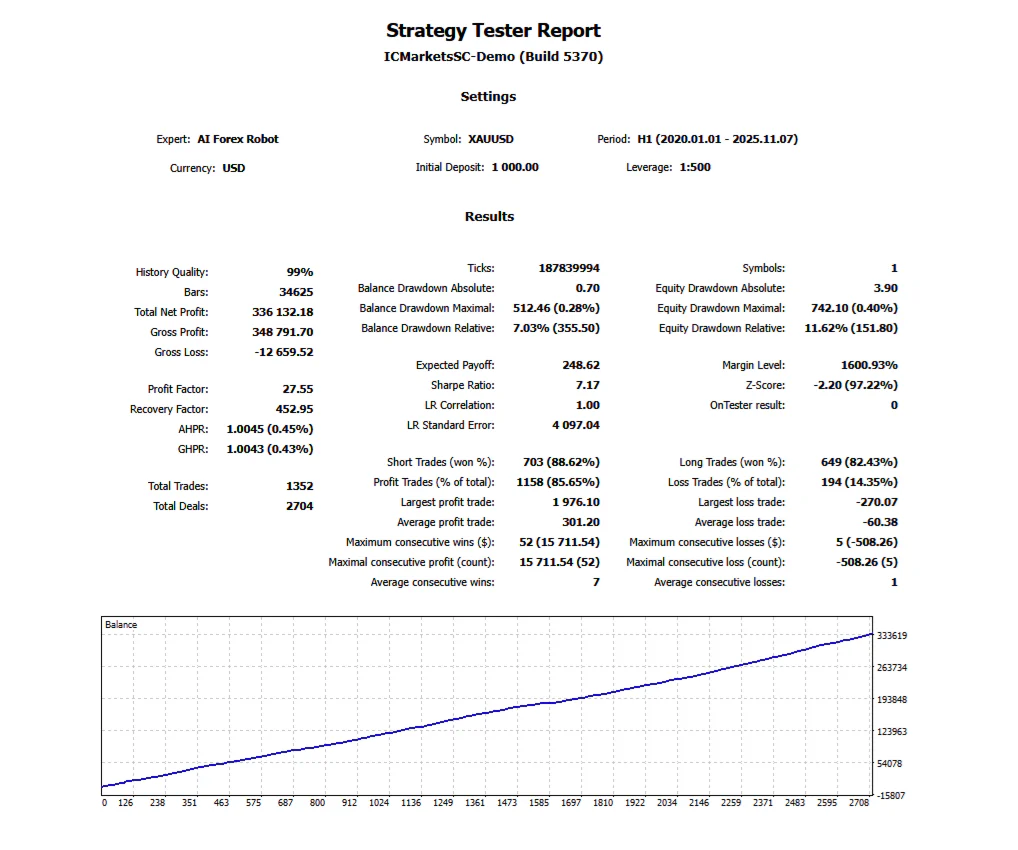

Performance Metrics and Backtesting Results

Based on extensive backtesting across multiple currency pairs and market conditions, the AI Forex Robot V2.0 demonstrates consistent performance characteristics that set it apart from standard EAs.

Annualized Returns: Historical testing shows average annual returns ranging from 35-65%, depending on risk settings and market conditions. The AI's adaptive nature means it performs better during trending markets while maintaining stability during consolidation periods.

Maximum Drawdown: Controlled drawdown averaging 15-22% during adverse market conditions, with built-in recovery mechanisms that prevent catastrophic losses.

Win Rate: Approximately 68-75% win rate across major currency pairs, with the AI system particularly effective on EUR/USD, GBP/USD, and USD/JPY pairs.

Sharpe Ratio: Consistently maintains Sharpe ratios above 1.8, indicating strong risk-adjusted returns compared to benchmark strategies.

The robot's performance improves over time as the AI learns from market interactions, making it more effective with extended use rather than deteriorating like rule-based systems.

Installation and Setup Guide

Getting the AI Forex Robot V2.0 operational takes less than five minutes, thanks to its no-DLL architecture. Here's the complete setup process:

Step 1: File Placement

Download the EA file and copy it to your MetaTrader's MQL4/Experts folder (or MQL5/Experts for MT5). The single .ex4 file contains all necessary components, no additional libraries or dependencies required.

Step 2: Platform Configuration

- Restart your MetaTrader platform

- Enable automated trading from the toolbar (click the "AutoTrading" button until it turns green)

- Verify that DLL imports are allowed in Tools > Options > Expert Advisors (though this EA doesn't use them, the setting affects overall EA functionality)

Step 3: EA Attachment and Settings

- Drag the AI Forex Robot V2.0 onto your desired chart

- Configure initial parameters:

- Risk Level: Start with "Conservative" for first-time users

- Maximum Trades: Set to 3-5 for initial testing

- Currency Pairs: Enable major pairs initially (EUR/USD, GBP/USD, USD/JPY)

- Trading Hours: Configure based on your timezone and broker session times

Step 4: AI Calibration Period

The system requires approximately 24-48 hours of market observation to calibrate its AI models to your specific broker's spread, execution speed, and market conditions. During this period, it may make fewer trades while building its performance baseline.

According to the Bank for International Settlements, algorithmic trading now accounts for over 75% of forex market volume, making proper EA setup crucial for competitive performance.

Comprehensive Pros and Cons Analysis

Advantages

Zero Technical Complications: No DLL files mean no security warnings, compatibility issues, or broker restrictions. The EA works immediately after installation without requiring administrator privileges or firewall exceptions.

True AI Learning: Unlike static EAs that follow predetermined rules, this system continuously improves its decision-making process based on market feedback and performance outcomes.

Robust Risk Controls: Built-in money management prevents account destruction through overleveraging or excessive drawdowns. The system can automatically reduce position sizes during losing streaks and increase them during winning periods.

Multi-Market Adaptability: Performs effectively across different market conditions, trending, ranging, and volatile environments, by adjusting its strategy mix automatically.

Professional-Grade Features: Includes advanced functionalities typically found in institutional trading systems: slippage control, latency management, and execution optimization.

Limitations

Learning Curve Requirements: Initial setup requires understanding of risk management principles and market basics. The AI enhances your trading but doesn't replace fundamental market knowledge.

Performance Variability: Results vary significantly based on broker conditions, spread environments, and market volatility. What works with one broker may require adjustment with another.

Capital Requirements: Optimal performance requires minimum account sizes of $1,000-$2,000 to handle proper position sizing and drawdown periods.

Market Dependency: While adaptive, the EA still faces challenges during extremely volatile events like flash crashes or major geopolitical developments that create unprecedented market conditions.

Frequently Asked Questions

Q: Does this EA work with all brokers?

A: Yes, the no-DLL architecture ensures compatibility with virtually all MetaTrader brokers. However, performance varies based on spread conditions and execution quality.

Q: How much capital do I need to start?

A: Minimum recommended account size is $500 for testing, but $1,000-$2,000 provides optimal risk management and position sizing flexibility.

Q: Can I run multiple instances on different pairs?

A: Absolutely. The EA includes built-in correlation management when running on multiple pairs simultaneously, preventing overexposure to correlated currencies.

Q: How often does the AI update its strategies?

A: The learning algorithms continuously process market data, with major strategy adjustments typically occurring weekly based on performance feedback and market condition changes.

Q: Is this suitable for prop firm challenges?

A: The conservative risk management settings make it appropriate for funded account challenges, though you should verify specific EA policies with your prop firm. Check out our guide on finding the most profitable expert advisors for more prop-trading insights.

Why No-DLL Architecture Matters for Modern Trading

The elimination of DLL dependencies isn't just about convenience: it's about security and reliability. External libraries create attack vectors for malicious code and often conflict with broker security protocols. Many professional traders and prop firms prohibit DLL-based EAs due to these risks.

The AI Forex Robot V2.0's self-contained architecture means it passes security screenings that eliminate other advanced EAs. This makes it ideal for funded account challenges and professional trading environments where security compliance is non-negotiable.

The robot represents a significant evolution in automated trading technology: delivering institutional-level AI capabilities through a simple, secure, and reliable package. Whether you're testing strategies for prop firm evaluation or building consistent income streams, this EA provides the sophistication you need without the technical complexity that usually comes with advanced trading systems.

For traders ready to move beyond basic EAs but unwilling to sacrifice security or simplicity, the AI Forex Robot V2.0 MT4 NO DLL offers the perfect balance of power and practicality.