5

Nov

Prop Firm Challenge Secrets: How Grid EAs and Perfect Money Management Beat 90% Failure Rates

Ever watched a promising trader blow through a $100,000 prop firm challenge in just three days? You're not alone. The brutal truth is that over 90% of traders fail these challenges, often losing their entry fees and walking away defeated. But here's what separates that elite 10% from the rest: they've cracked the code on systematic trading through grid Expert Advisors (EAs) combined with bulletproof money management.

The statistics don't lie. According to industry research, only 5-10% of prop firm challenge participants actually pass and secure funded accounts. Most fail not because they lack trading knowledge, but because they approach these challenges like gambling instead of systematic business operations.

Why Most Traders Crash and Burn

The path to prop firm failure follows predictable patterns. Emotional revenge trading after a few losses. Risking 5-10% per trade instead of the recommended 1-2%. Abandoning proven systems when they hit their first drawdown period. These aren't random mistakes: they're systematic flaws that grid EAs can eliminate.

Traditional discretionary trading puts you at the mercy of your emotions every single trade. You're making split-second decisions under pressure, often second-guessing your strategy right when you need consistency most. Grid EAs remove this human element entirely, executing your predefined strategy with mechanical precision.

Understanding Grid EAs: Your Automated Edge

Grid Expert Advisors operate on a simple yet powerful principle: they place buy and sell orders at predetermined intervals above and below the current market price, creating a "grid" of pending orders. As price moves through these levels, the EA systematically captures profits while managing risk through position averaging and strategic hedging.

Unlike scalping EAs that hunt for quick pips, grid systems thrive in ranging markets: which represent roughly 70% of all trading conditions. They work by:

- Automated Order Placement: Setting buy orders below current price and sell orders above, spaced at regular intervals

- Dynamic Position Management: Adding to winning positions while hedging losing ones

- Profit Lock-in Mechanisms: Closing profitable legs of the grid while maintaining market exposure

- Drawdown Recovery: Using position averaging to recover from temporary adverse price movements

The key advantage? Grid EAs never panic. They never revenge trade. They execute your strategy exactly as programmed, trade after trade, without the emotional baggage that destroys human traders.

Setting Up Grid EAs on MT4/MT5: The Technical Blueprint

Your prop firm success starts with proper EA installation and configuration. Here's the step-by-step process that separates profitable grid trading from account-blowing disasters.

MT4 Setup Process:

- Download your grid EA file (.ex4 format) and place it in the MetaTrader 4/MQL4/Experts folder

- Restart MT4 and drag the EA onto your chosen currency pair chart

- In the "Common" tab, enable "Allow live trading" and "Allow DLL imports"

- Configure your grid parameters: start lot size (typically 0.01), grid step (20-50 pips), maximum grid levels (5-10 for prop challenges)

MT5 Configuration: The process mirrors MT4 but uses .ex5 files in the MQL5/Experts folder. MT5 offers enhanced backtesting capabilities, allowing you to verify your grid settings against years of historical data before risking real capital.

Critical Parameters for Prop Challenges:

- Grid Step: 30-50 pips for major pairs ensures orders don't bunch together

- Max Grid Levels: Limit to 6-8 positions maximum to control exposure

- Lot Multiplier: Keep at 1.0 or 1.2: aggressive multiplication kills accounts

- Take Profit: Set at 20-40 pips per grid level

- Magic Number: Use unique identifiers to separate different EA instances

The proper EA setup on VPS ensures your grid system runs without interruption, critical for prop firm consistency requirements.

Money Management: The Foundation of Prop Success

Perfect money management transforms grid EAs from dangerous gambling tools into precision profit machines. Your money management rules must align with prop firm requirements while maximizing your profit potential.

The 1% Rule in Practice: On a $100,000 challenge account, risk exactly $1,000 per complete grid cycle: not per individual order. If your grid opens 5 positions, each position should risk roughly $200. This approach keeps your total exposure within safe limits even during extended drawdown periods.

Dynamic Position Sizing: Start each grid cycle with 0.01 lots per $10,000 of account balance. As your account grows, proportionally increase position sizes. A $100,000 account begins with 0.10 lots maximum per grid level, scaling up only after securing profits.

Drawdown Protection Strategies: Implement hard stops at 4-5% account drawdown. Most prop firms allow 8-10% maximum drawdown, but protecting yourself at 5% provides a crucial safety margin. Your grid EA should automatically reduce position sizes or pause trading when approaching these thresholds.

The Fatal Mistakes That Kill Grid Traders

Understanding common grid trading failures helps you avoid the pitfalls that destroy 90% of challenge attempts.

Mistake #1: Oversized Grid Steps Placing grid levels too close together creates excessive position density. When price moves against you, you'll accumulate massive exposure quickly. Maintain minimum 25-pip spacing on major pairs.

Mistake #2: Unlimited Grid Levels Running grids without maximum position limits guarantees eventual account destruction. Professional grid traders never exceed 8-10 simultaneous positions, regardless of market conditions.

Mistake #3: Ignoring Economic Events Grid systems perform poorly during high-impact news releases. Suspend grid trading 30 minutes before and after major economic announcements like NFP, FOMC decisions, or central bank meetings.

Mistake #4: Currency Pair Mismatching Not all pairs suit grid strategies. Trending pairs like USD/JPY often break grid systems, while ranging pairs like EUR/GBP provide ideal conditions. Focus on pairs with established support/resistance levels.

Advanced Grid Strategies for Prop Excellence

Professional prop traders enhance basic grid systems with sophisticated techniques that maximize profit while minimizing risk exposure.

Asymmetric Grid Deployment: Instead of symmetrical buy/sell grids, weight your orders based on market bias. In uptrending markets, place more buy orders below price than sell orders above. This approach captures trend momentum while maintaining grid protection.

Correlation-Based Grid Management: Run grids on negatively correlated pairs simultaneously. When EUR/USD grid positions move negative, USD/CHF positions often move positive, naturally hedging your exposure across the portfolio.

Time-Based Grid Activation: Activate grid systems during specific market sessions when your chosen pairs exhibit ranging behavior. London session typically offers excellent grid conditions for EUR pairs, while Asian session favors JPY crosses.

Profit Compounding Systems: Reinvest grid profits systematically to accelerate account growth. After each 5% account increase, proportionally increase your grid position sizes while maintaining the same risk percentage.

Risk Management Beyond the Basics

Successful prop traders implement multiple layers of protection that extend far beyond simple stop-losses.

Account Correlation Limits: Never run identical grid systems on highly correlated pairs simultaneously. EUR/USD and GBP/USD grids can amplify losses during USD strength periods, violating diversification principles.

Maximum Daily Loss Limits: Set daily loss limits at 1.5-2% regardless of monthly progress. This prevents single bad trading days from derailing entire challenge attempts.

Grid Recovery Protocols: Develop systematic approaches for recovering from grid drawdowns. This might involve temporarily reducing grid density, switching to lower-volatility pairs, or implementing partial position closures at predetermined levels.

For traders seeking professional-grade grid solutions, explore comparing different automated strategies to find the optimal approach for your prop firm requirements.

Execution Excellence: Turning Strategy Into Results

The difference between prop firm success and failure often comes down to execution consistency. Your grid EA handles trade mechanics, but you control the broader strategic elements.

Session-Based Trading Plans: Develop specific protocols for different market sessions. Asian session grids might focus on JPY pairs with tighter ranges, while London session strategies can accommodate wider grid steps on EUR pairs.

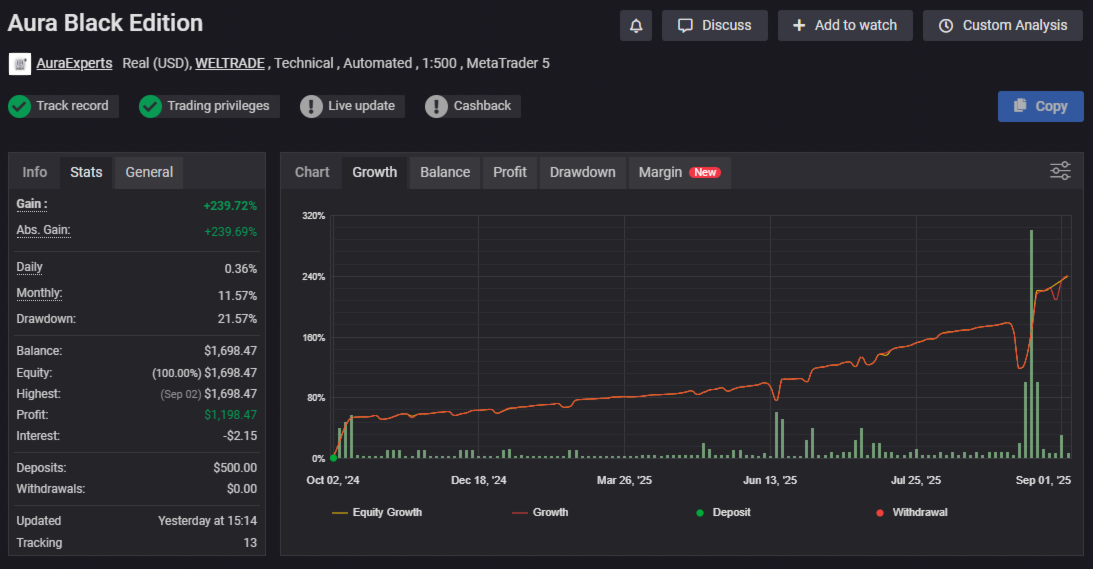

Performance Monitoring Systems: Track key metrics beyond simple profit/loss: maximum concurrent positions, average time in trade, win rate per grid level, and correlation between different grid instances. These metrics reveal optimization opportunities invisible in standard trading reports.

Stress Testing Protocols: Before deploying any grid system on your prop challenge, run extensive backtests covering various market conditions: trending periods, ranging markets, high volatility events, and correlation breakdowns. Your system must perform adequately across all scenarios.

The prop trading landscape rewards systematic approaches over discretionary gambling. Grid EAs, when properly configured and managed, provide the mechanical consistency that transforms 90% failure rates into sustainable profitability. Combined with disciplined money management and professional risk controls, these systems offer your best opportunity to join the elite minority of successful prop traders.

Success isn't about finding secret strategies: it's about executing proven systems with unwavering discipline while the majority of traders let emotions destroy their accounts.