22

Sep

Stop Losing Money: 10 Forex Trading Bot Mistakes That Kill Accounts (And How to Fix Them)

Forex Trading Bot Mistakes can destroy your account faster than any market crash. Discover the 10 deadliest errors traders make—and how to fix them before they cost you everything.Ever watch your trading bot turn a promising month into a complete disaster? You're not alone. Over 75% of retail traders using automated systems still lose money: not because the bots don't work, but because of critical implementation mistakes that destroy accounts faster than any market crash.The brutal truth? Most traders sabotage their own success before their bot even gets a fair chance to perform. Here are the 10 deadliest mistakes that kill forex trading accounts, and more importantly, how to fix them before they cost you everything.

Mistake #1: Running Bots Without Proper Backtesting

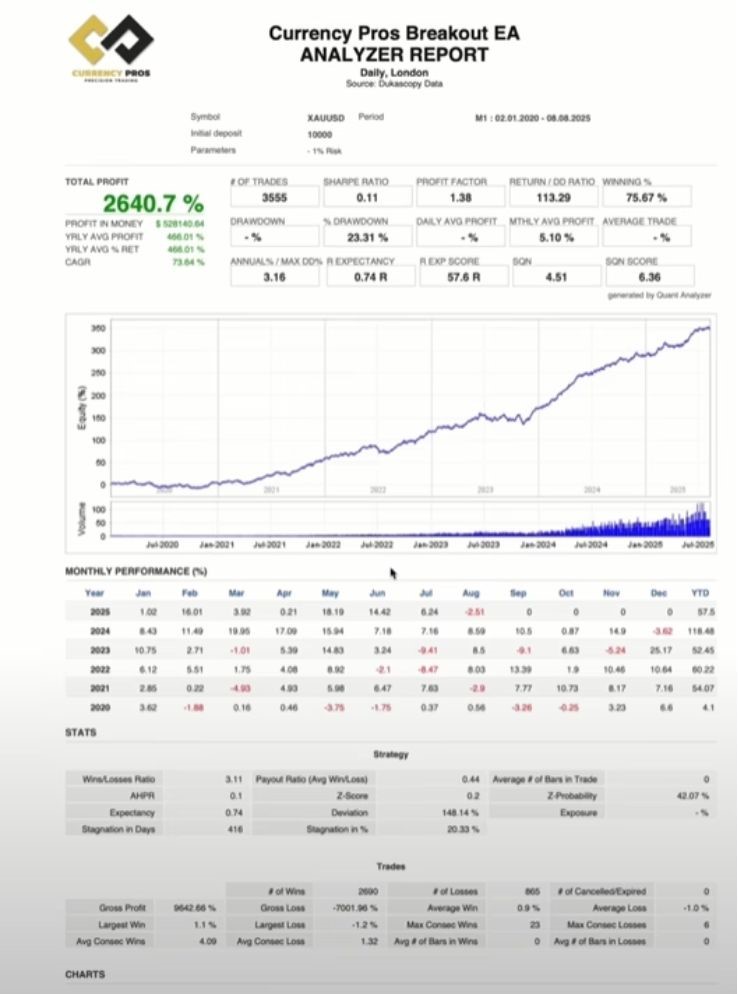

The most devastating error new users make is downloading a bot from Telegram channels or online marketplaces and immediately running it on live accounts. This creates a ticking time bomb: you have no idea how your bot behaves during volatile periods, news events, or extended drawdowns.The Fix: Run comprehensive backtests over at least 12 months of data using quality platforms like MT5's Strategy Tester or specialized tools like Tick Data Suite. Focus on analyzing maximum drawdown, consecutive losses, and performance during major economic events. A bot showing 70% win rate but 30% drawdown signals serious underlying issues that need investigation before live deployment.

Mistake #2: Setting Unrealistic Risk Levels

Aggressive lot sizing destroys accounts faster than any market condition. Traders, especially younger ones chasing quick profits, often use excessive risk per trade with martingale or grid bots. Even profitable systems will blow accounts when run at dangerous risk levels during inevitable losing streaks.The Fix: Limit risk to 1-2% of account equity per trade, regardless of your bot's historical performance. Use position sizing calculators and never increase lot sizes based on recent wins. Your account needs to survive the worst possible drawdown scenario, not just average market conditions.Mistake #3: Ignoring Market Conditions

Most bots are designed as either trend-following or mean-reversion systems, but users let them run 24/7 without considering market type. A scalping bot during high-impact news events generates chaos, while trend-following systems in sideways markets create frequent stop-outs.The Fix: Understand your bot's core logic and use economic calendars from Forex Factory to plan activity around major events. Learn to identify trending versus ranging market conditions and adjust bot operation accordingly. Some bots should be paused during NFP releases or central bank announcements.Mistake #4: Using Unverified or Scam Bots

The explosion of cheap, unregulated trading systems sold through social media creates massive security and performance risks. These bots often contain malicious scripts, fake performance records, and zero real trading history verification.The Fix: Only download bots from verified sources with transparent performance histories and regulatory backing. Look for audited backtests, regulated broker partnerships, and detailed documentation. Avoid anonymous sellers making unrealistic profit claims or pressuring quick purchases.

Mistake #5: The "Set and Forget" Mentality

Markets evolve constantly, and static bots that don't adapt to changing conditions eventually fail. A bot performing excellently for 6-12 months can suddenly become ineffective when market dynamics shift: correlation changes, volatility patterns evolve, or central bank policies alter price behavior.The Fix: Schedule regular performance reviews every 30-60 days. Monitor key metrics like win rate changes, average trade duration shifts, and drawdown patterns. Be prepared to pause, optimize, or replace bots that show declining performance over multiple market cycles.Mistake #6: Overtrading Through Automation

Overtrading is the number one account killer for forex traders, and automation can amplify this problem when not properly controlled. Bots taking excessive positions or trading through inappropriate market conditions create death-by-a-thousand-cuts scenarios.The Fix: Implement daily loss limits and maximum daily trade counts in your bot settings. Use equity protection features that automatically pause trading after reaching predetermined loss thresholds. Monitor trade frequency and ensure your bot isn't churning the account with excessive activity.Mistake #7: Poor Risk Management with Dangerous Strategies

Martingale and cost-averaging strategies show consistent short-term profits but represent the most dangerous approaches in forex trading. These systems double position sizes after losses, creating exponentially growing risk that can wipe out accounts during extended losing streaks.The Fix: Avoid bots using martingale, grid, or averaging-down strategies unless you fully understand their risk profile. If you must use them, implement strict equity drawdown limits and never risk more than 10% of your account to these high-risk systems. Consider them entertainment money, not serious trading capital.

Mistake #8: Improper Broker Integration

Execution delays, slippage issues, and synchronization problems can turn profitable strategies into losers. Many traders don't verify their broker's compatibility with their chosen bot or fail to account for spread variations and execution speeds that affect performance.The Fix: Test your bot on demo accounts with your specific broker before going live. Verify execution speeds, spread consistency, and any requote issues during different market sessions. Some bots work better with ECN brokers, while others need market makers: know your requirements.Mistake #9: Ignoring Rollover Times

Rollover mechanics between 10 PM and 11 PM UK time can create unexpected losses on otherwise profitable positions. The market doesn't need to reach stop-loss levels for trades to close at losses due to swap rates and position adjustments during these periods.The Fix: Understand your bot's behavior during rollover periods and consider avoiding new positions or closing existing ones before these times if your strategy is sensitive to swap costs. Monitor overnight positions carefully and factor rollover costs into your profit expectations.

Mistake #10: Constantly Switching Bot Strategies

This behavior, often triggered by watching new tutorials or tips, creates a cycle where no strategy gets adequate time to prove its worth. Switching between different bots or constantly tweaking parameters prevents proper evaluation of any single system's effectiveness.The Fix: Commit to testing each bot for at least 100 trades or 3 months before making changes. Keep detailed logs of modifications and their impacts on performance. Resist the urge to abandon strategies during normal drawdown periods: every profitable system experiences temporary losses.Your Action Plan for Bot Trading Success

The difference between successful and failed bot trading comes down to proper implementation, not the bot itself. Start by auditing your current setup against these 10 mistakes. Fix the most critical issues first: inadequate backtesting and excessive risk levels destroy more accounts than all other factors combined.Remember, even the best trading bots require intelligent human oversight. Your job isn't to find the perfect robot: it's to create the perfect environment for consistent, sustainable automated trading success.Build your protection systems now, before the next market crash tests every weakness in your automated trading approach. Your account balance will thank you when others are explaining why their "sure thing" bot suddenly stopped working.

Share: