2

Oct

How to Scale a Trading Account FAST in 2025 (Proven System)

Ever feel like you're stuck in an endless loop of small wins followed by devastating losses? Six years ago, I was that 17-year-old kid trading $50 accounts, convinced I could turn pocket change into life-changing money in a matter of weeks.

Well, I managed to turn $50 into $200 in one day, then watched it all disappear the next. Sound familiar?

Fast forward to today: I'm pulling in 6 figures per month from trading. But here's the thing, if I had to start over in 2025 with a small account, I wouldn't do what most traders are doing. Instead, I'd use these 4 proven secrets that took me from blowing $20 accounts to managing serious capital.

The last secret is the real game-changer, and it's exactly how I went from desperation trading to consistent profitability.

Secret #1: Quality Over Quantity (Stop the Overtrading Madness)

The Myth That's Killing Your Account

Most traders think more trades equal more profits. I lived this nightmare for years, opening charts at 7 a.m., hunting for any price movement, and staying glued to screens until 10 p.m. trying to trade every session.

I felt like I was missing out if I wasn't in a trade. Result? More than 10 trades a day, hoping one would finally make me rich.

Here's why this approach is financial suicide: Let's say you have a $500 account and risk $50 per trade (10% risk). You take 10 random trades daily with a 1:1 risk-reward ratio and a 50% win rate.

Even winning 5 and losing 5 puts you in the red because of spreads and commissions. You're slowly bleeding your account to death.

The Question That Changed Everything

When I was finally tired of blowing account after account, I started asking myself one simple question before every trade:

"If I had a $100,000 account, would I still take this trade?"

- If the answer is no, don't take it

- If the answer is yes, it's probably an A+ setup

An A+ setup is clear, clean, high probability, follows your proven strategy, and has multiple confirmations. This shift from quantity to quality transformed everything.

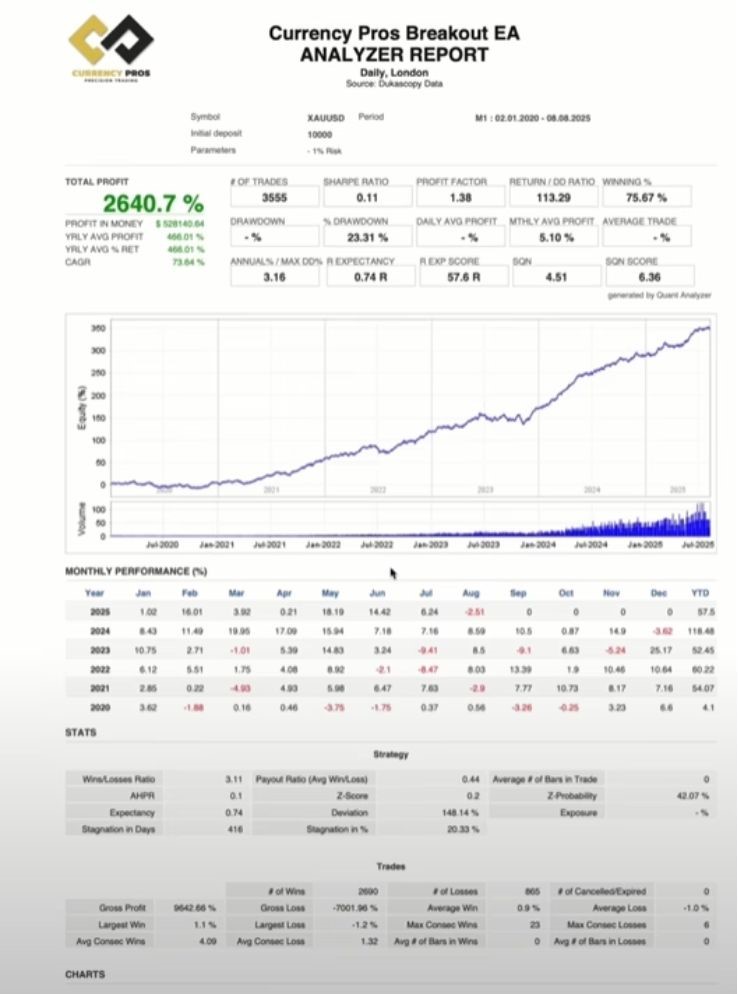

Pro tip for FXShop24 users: If you're using Expert Advisors, make sure they're programmed with strict entry criteria. A well-configured EA like the ones from FXShop24's collection can help you avoid the emotional trap of overtrading by sticking to predetermined setups.

Secret #2: Focus on Risk-Reward Ratios, Not Lot Sizes

The Over-Leverage Trap

I used to think growing fast meant cranking up lot sizes. Why make $5 per trade when I could make $50 by increasing leverage, right?

This thinking led to some wild days: I once turned $500 into $9,000 in just 3 days. The video is still on my channel from years ago. But here's the brutal truth: luck always runs out.

One bad trade wiped everything out.

The Smart Money Approach

Let's compare two traders:

Trader A (High Risk):

- Starting account: $500

- Risk per trade: $100 (20% of account)

- After 3 consecutive losses: down $300 (60% of account)

Trader B (Smart):

- Starting account: $500

- Risk per trade: $5 (1% of account)

- After 3 losses: still has 97% of account

Even the best traders lose 40% of their trades. The question isn't whether you'll lose: it's whether you'll survive those losses.

The System That Works

Instead of chasing quick flips, I focused on smart trades with high risk-reward ratios:

- Risk only 1% of the account per trade

- Target a 5:1 risk-reward ratio

This means making $50 while only risking $10. Lose 5 in a row? You're down $50. Win 5 in a row? You're up $250.

According to research from Investopedia, professional traders consistently use position sizing and risk management as their primary tools for long-term success.

Secret #3: Use Smart Leverage, Not Maximum Leverage

The 500:1 Disaster

When I started, I cranked leverage to 1:500, thinking higher leverage meant bigger profits. At first, it seemed amazing: small moves were generating huge returns.

Then reality hit. One small move against me and boom: margin call. My entire account vanished before I could react.

High leverage doesn't just amplify gains; it amplifies losses with equal force. The higher the leverage:

- The less room you have to breathe

- You get stopped out faster

- Your emotions go through the roof

- You start making desperate moves to recover

The Game-Changer

I lowered my leverage to 1:50, and for the first time, my trades had room to breathe. Instead of getting stopped out in seconds, my setups had time to work.

I started trading smaller lots: 0.01 or 0.05 on a $500 account instead of going all-in. The best part? My trading became way less stressful:

- No more panic selling

- No more account-destroying single trades

- I finally understood that leverage should be a tool, not a gambling mechanism

FXShop24 insight: When using automated systems, lower leverage becomes even more critical. EAs like the Fort Knox EA are designed to work optimally with conservative leverage, allowing the algorithm to manage risk systematically without emotional interference.

Secret #4: Scale with One Strategy (The Commitment That Changes Everything)

The Strategy-Hopping Nightmare

For years, I was constantly switching strategies:

- One week: scalping

- Next week: smart money concepts

- Then: "This YouTube strategy will make me rich!"

Every time I switched, I started from scratch. I never gave any strategy enough time to master it, so I was never confident in my trades.

My Commitment

I finally made a commitment: choose one strategy and stick with it, no matter what. For me, it was market mechanics.

I started to:

- Journal every trade

- Track what worked and what didn't

- Refine entries over time

I stopped jumping ship every time I had a few losses. Instead, I focused on making my strategy better.

The Result

This created the biggest shift in my results:

- Instead of trading with doubt, I traded with confidence

- Instead of reacting emotionally, I followed a proven system I trusted

The reality: If you keep switching strategies, you'll always be a beginner. But if you stick to one and focus on improvement, you'll get better with every single trade.

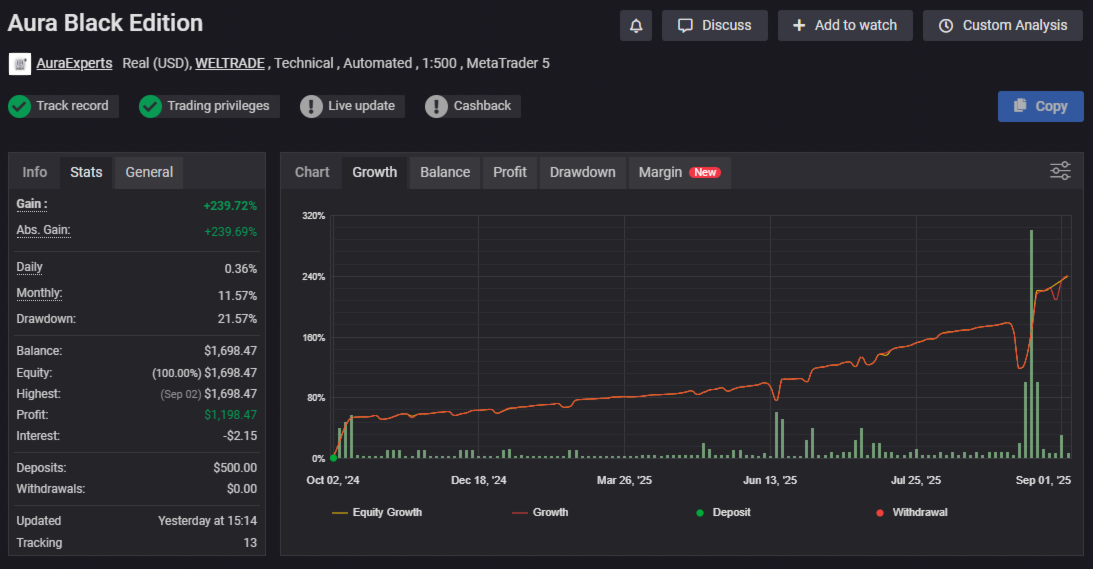

For EA users: This principle applies even more strongly to automated trading. Pick a reliable Expert Advisor with proven track records, like those available at FXShop24, and let it run consistently rather than constantly switching between different EAs based on short-term performance.

The Hidden Secret: Compound Psychology

Here's what most traders miss: scaling isn't just about the numbers, it's about the psychology. Each of these secrets builds on the others:

- Quality trades reduce emotional stress

- Smart risk-reward protects your capital

- Proper leverage gives you breathing room

- One strategy builds unshakeable confidence

When you combine all four, something magical happens: you start thinking like a professional trader instead of a gambler.

Your Next Steps

Stop trying to flip accounts overnight. Start thinking in terms of:

- Protecting capital first

- Building consistency second

- Growing profits third

The market will always be there tomorrow. Your account might not be if you don't start implementing these secrets today.

Remember: nothing changes if nothing changes. Pick one secret from this list and implement it in your trading this week. Your future self will thank you.

The path from small accounts to serious money isn't about luck: it's about following a proven system that prioritizes survival over quick gains. Master these fundamentals, and you'll be amazed at how fast your account can grow when it's built on a solid foundation.