11

Nov

How to Backtest an Expert Advisor on MT5: Step-by-Step for Beginners

Ever stared at a shiny new forex robot promising massive returns, wondering if it actually works? You're not alone. Most traders jump straight into live trading with an expert advisor mt5 without testing it first: and that's exactly how accounts get blown.

Smart traders know the secret: backtest everything before risking real money. Today, you'll learn exactly how to put any MT5 robot through its paces using MetaTrader 5's built-in Strategy Tester. No guesswork, no gambling: just cold, hard data.

Why Backtesting Your MT5 Expert Advisor Matters

Before we dive into the how-to, let's get real about why this matters. A forex trading bot might look impressive in marketing screenshots, but those results mean nothing without proper validation. Backtesting shows you how your trading strategy would have performed in real market conditions: complete with slippage, spreads, and all the messy details that separate winners from losers.

The difference between successful traders and the rest? They validate first, trade second.

What You Need Before Starting

Getting your setup right prevents headaches later. Here's your pre-flight checklist:

Essential Requirements:

- MetaTrader 5 platform (updated to latest version)

- Your Expert Advisor file (.ex5 format)

- Quality historical data from your broker

- Clear understanding of your trading strategy's rules

Pro Tip: Garbage data equals garbage results. Make sure your broker provides accurate historical data for the symbols you're testing. Some brokers offer limited history, which can skew your backtest results completely.

Step-by-Step Backtesting Process

Step 1: Open the Strategy Tester

Launch your MetaTrader 5 terminal and access the Strategy Tester using Ctrl+R, or navigate to View → Strategy Tester from the menu. The Strategy Tester panel appears at the bottom of your screen: this becomes your mission control for the entire process.

Step 2: Load Your Expert Advisor

In the Strategy Tester panel, you'll see a dropdown menu labeled "Expert Advisor." Click it and select your metatrader 5 expert advisor from the list. If your EA doesn't appear, you'll need to copy the .ex5 file to your MetaTrader 5's MQL5/Experts folder and restart the platform.

Step 3: Configure Your Test Parameters

This step separates amateur backtests from professional validation. Set these parameters carefully:

Symbol Selection: Choose the currency pair or instrument your forex robot mt5 was designed to trade. Don't test a EURUSD strategy on GBPJPY: you'll get meaningless results.

Timeframe: Match this to your strategy's operating timeframe. If your EA makes decisions based on 1-hour candles, select H1.

Date Range: Here's where most beginners go wrong. Don't just test the last few months of bull market. Include various market conditions:

- Trending markets (both up and down)

- Sideways, choppy periods

- High volatility events (NFP releases, central bank announcements)

Testing Model: MT5 offers three options:

- Every tick based on real ticks: Most accurate but slowest

- 1-minute OHLC: Good balance of speed and accuracy

- Open prices only: Fastest but least precise

For your first test, use 1-minute OHLC. Reserve tick-based testing for final validation of promising strategies.

Step 4: Set Realistic Account Conditions

Configure these settings to mirror real trading conditions:

- Deposit: Use your actual account size or planned deposit

- Leverage: Match your broker's leverage offering

- Execution Delay: Enable this to simulate real-world slippage

Many traders skip this step and wonder why their live results differ from backtests. Don't be one of them.

Step 5: Run Your Backtest

Click the Start button and watch the magic happen. MT5 processes your expert advisor's logic against historical market data, simulating every trade your strategy would have made.

Processing time varies based on:

- Date range length

- Testing model selected

- EA complexity

- Your computer's processing power

Grab a coffee: good things take time.

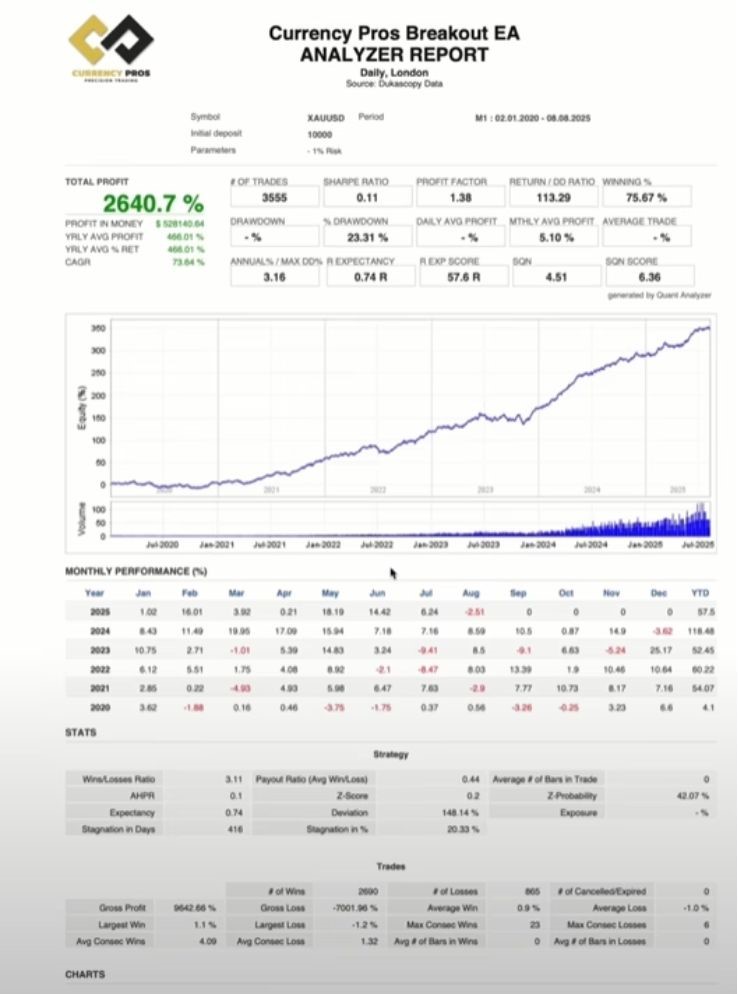

Understanding Your Results

Once your backtest completes, MT5 presents results across four critical tabs:

Results Tab

Shows every individual trade with entry/exit details, profit/loss, and timing. Scan for patterns: are losses clustered during specific market events? Do profitable trades follow certain setups?

Graph Tab

Your strategy's equity curve tells the real story. A smooth upward slope indicates consistent performance. Wild swings or extended flat periods reveal potential issues with your trading strategy.

Report Tab

The money section. Key metrics to focus on:

- Total Profit/Loss: Your bottom line

- Profit Factor: Gross profit divided by gross loss (aim for 1.5+)

- Maximum Drawdown: Largest peak-to-valley decline

- Win Rate: Percentage of profitable trades

- Average Trade: Expected value per trade

Journal Tab

Error messages and warnings appear here. Pay attention: these often reveal data issues or EA bugs that invalidate your results.

Common Backtesting Mistakes (And How to Fix Them)

Problem 1: Testing Only Bull Markets Many traders cherry-pick favorable periods, creating false confidence. Solution: Test across multiple market cycles and conditions.

Problem 2: Ignoring Spreads and Commissions Your backtest shows 50% returns, but you forgot about costs. Always include realistic spreads and commission structures in your test settings.

Problem 3: Curve Fitting Over-optimizing parameters to match historical data perfectly. This creates strategies that work great on past data but fail miserably in live markets. According to Investopedia's guide on backtesting, this remains one of the biggest pitfalls in strategy development.

Problem 4: Insufficient Data Testing three months of data proves nothing. Use at least 2-3 years of historical data, preferably more.

Advanced Tips for Better Backtests

Visual Mode: Enable this feature to watch your strategy trade in real-time during backtests. It's slower but invaluable for understanding your EA's behavior during specific market conditions.

Forward Testing: After backtesting, run your strategy on a demo account for several weeks. This bridges the gap between historical data and live market conditions.

Multi-Symbol Testing: If your forex trading bot trades multiple pairs, test each symbol individually before combining them. Some EAs perform well on major pairs but struggle with exotics.

Optimization: The Next Level

Once you've mastered basic backtesting, MT5's optimization feature lets you fine-tune your strategy parameters. But remember: optimization is a double-edged sword. Too much tweaking creates curve-fitted strategies that fail in real markets.

Use optimization to find robust parameter ranges, not perfect historical fits.

Moving from Backtest to Live Trading

Your backtest results look promising: now what? Don't jump straight to live trading. Follow this progression:

- Demo Testing: Run your strategy on a demo account for at least one month

- Small Live Account: Start with minimal risk to validate real-market performance

- Scale Gradually: Increase position sizes only after consistent profitable results

Remember, backtesting shows what could have happened, not what will happen. Market conditions evolve, spreads change, and execution differs between backtests and reality.

The Bottom Line

Backtesting your MT5 expert advisor isn't just recommended: it's essential for long-term trading success. You now have the tools and knowledge to validate any forex robot before risking real capital.

The Strategy Tester gives you a crystal ball into your strategy's potential performance. Use it wisely, test thoroughly, and always remember: past performance doesn't guarantee future results, but it's infinitely better than blind faith.

Your next winning strategy might be just one backtest away. The question is: will you take the time to find out, or join the ranks of traders who learn the hard way?

Start testing, start learning, and most importantly: start winning with data-driven decisions rather than hope and hype.