3

Aug

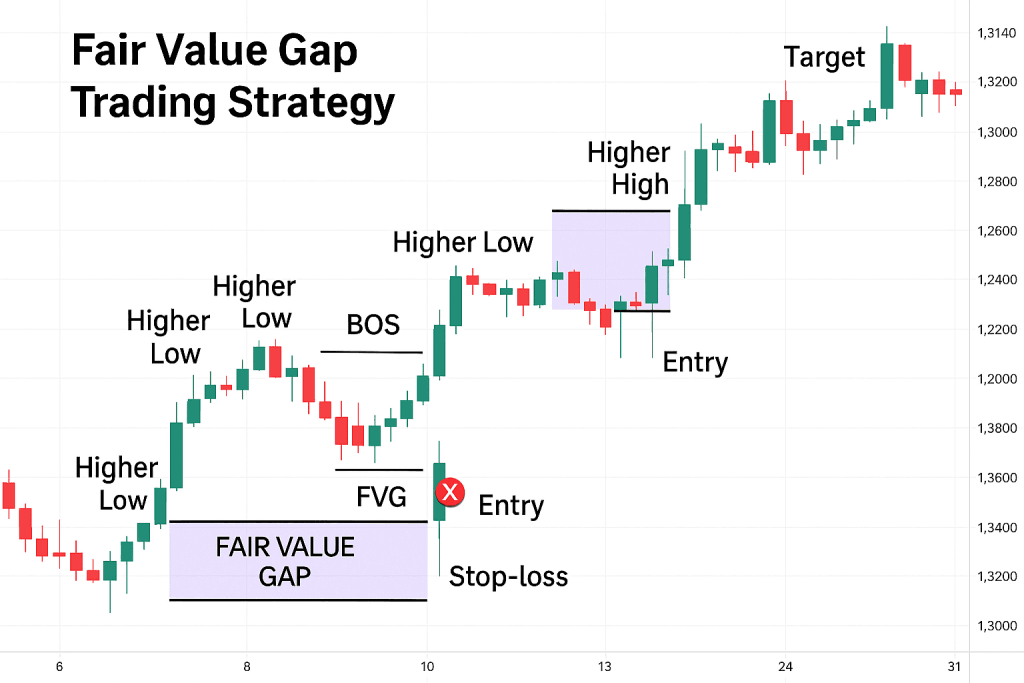

Fair Value Gap Trading Strategy

Ever feel like the market knows exactly where your stop-loss is? That’s not paranoia — it’s institutional behavior. The Fair Value Gap Trading Strategy helps you decode those moves and trade in sync with the smart money.

In this guide, you’ll learn how to spot Fair Value Gaps (FVGs), why they matter, and how to build a strategy around them that mirrors institutional order flow.

🧠 What Is a Fair Value Gap?

A Fair Value Gap is a price imbalance created when the market moves aggressively in one direction, leaving a gap between candlesticks. It’s a sign that liquidity was consumed rapidly — often by institutional orders.

How to identify it:

- Look for a three-candle pattern.

- The first and third candles do not overlap.

- The middle candle shows a strong directional move.

These gaps act like magnets — price often returns to “fill” them before continuing its trend.

🧭 Why Institutions Use FVGs

Institutions don’t chase price — they create imbalances to find liquidity. FVGs are:

- Zones of inefficiency where price moved too fast.

- Targets for mitigation, where institutions return to fill unexecuted orders.

- High-probability entry zones when aligned with market structure.

🛠️ How to Build a Fair Value Gap Trading Strategy

Here’s a step-by-step framework:

1. Define Market Structure

- Identify trend direction: uptrend (higher highs/lows) or downtrend (lower highs/lows).

- Look for Break of Structure (BOS) or Change of Character (ChoCH) to confirm bias.

2. Spot the FVG

- Use H1 or H4 timeframes for clarity.

- Mark the gap between the first and third candles.

3. Wait for Price to Return

- Don’t chase the breakout.

- Let price revisit the FVG zone naturally.

4. Confirm on Lower Timeframes

- Drop to M15 or M5 and look for:

- Rejection wicks

- Engulfing candles

- Volume spikes

5. Enter with Risk Management

- Stop-loss: just beyond the FVG zone.

- Target: next swing high/low or liquidity pool.

🎯 Real-World Example

Let’s say GBP/USD breaks structure upward on H1. You spot a Fair Value Gap during the breakout. Price retraces into the FVG zone. On M15, you see a bullish engulfing candle with rising volume.

✅ Entry: At the base of the FVG ❌ Stop-loss: Just below the gap 🎯 Target: Next swing high or liquidity zone

📌 Pro Tips for FVG Traders

- Confluence is king: Combine FVGs with Order Blocks, liquidity zones, and Points of Interest (POIs).

- Use higher timeframes for cleaner setups.

- Avoid isolated FVGs without structure or confirmation.

🧰 Tools That Help

While SMC is a discretionary method, these tools can assist:

- Lux Algo: Highlights FVGs and Order Blocks visually.

- Volume Profile: Confirms institutional interest.

- Time-based liquidity indicators: Show session highs/lows.

📊 Example: Trading a Fair Value Gap on GBP/USD (H1 Timeframe)

🧭 Market Structure

- The chart shows a clear uptrend with higher highs and higher lows.

- A Break of Structure (BOS) occurs when price closes above a previous swing high.

⚡ Fair Value Gap Formation

- During the breakout, a strong bullish candle forms.

- The next candle opens higher, creating a Fair Value Gap between the first and third candles.

- This gap is a sign of institutional imbalance — price moved too fast, leaving inefficiency.

🎯 Entry Setup

- Price retraces into the FVG zone.

- On M15, a bullish engulfing candle appears with rising volume.

- This confirms institutional interest.

📌 Trade Details

- Entry: At the base of the FVG zone.

- Stop-loss: Just below the FVG.

- Target: Next swing high or liquidity pool.

🧭 Final Thoughts

The Fair Value Gap Trading Strategy isn’t just another pattern — it’s a window into how institutions operate. By mastering this concept, you stop reacting and start anticipating. You’re no longer trading noise — you’re trading intent.

Want help applying this to a real chart or building a strategy around it? Drop a comment or reach out — let’s decode the market together.