8

Nov

Dynamic Pips EA MT4 Review: Diversified, Smart, and Customizable Trading

Ever feel like putting all your trading eggs in one currency pair basket is a recipe for disaster? You're absolutely right. The forex market's unpredictable nature demands a smarter approach: one that spreads risk across multiple opportunities while maintaining intelligent control over your capital.

Enter Dynamic Pips EA MT4, an expert advisor that's rewriting the rulebook on automated forex trading through portfolio-wide diversification and adaptive risk management. This isn't your typical single-pair scalper or dangerous martingale system. Instead, it's a sophisticated forex trading bot designed for traders who understand that sustainable profits come from smart money management and strategic diversification.

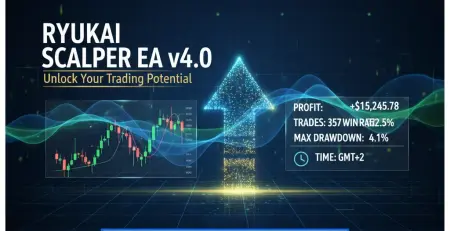

Real Performance, Real Numbers

The proof is in the trading results. Dynamic Pips EA has delivered verified performance that speaks volumes about its capabilities. Starting with a $2,500 initial deposit, the EA generated $438,322.77 in total equity, translating to $435,822.77 in net profit: an extraordinary +17,432.9% profit growth with an average monthly return exceeding 120%.

What makes these numbers even more impressive? The maximum drawdown remained at a manageable 14.8%, demonstrating the EA's commitment to capital preservation even during aggressive profit-taking phases. The win rate consistently hovers above 88% across primary trading pairs, including the volatile XAUUSD and stable EURUSD markets.

Strategy That Actually Makes Sense

Unlike many MT4 EAs that rely on risky martingale or grid systems, Dynamic Pips employs a hybrid strategy combining trend-following, breakout analysis, and real-time volatility tracking. The EA's core strength lies in its AI-powered momentum analysis that scans momentum patterns across four different timeframes using neural-pattern algorithms.

This multi-layered approach allows the system to detect:

- Momentum shifts before they become obvious to retail traders

- Volatility spikes that create profitable opportunities

- Support and resistance zones using advanced price action analysis

- Fibonacci retracement levels for precise entry timing

The strategy explicitly avoids curve-fitting or over-optimization, focusing instead on robust, repeatable trading logic that performs consistently across different market conditions.

The Power of Multi-Pair Diversification

Here's where Dynamic Pips EA truly shines: its portfolio-focused design that trades across more than 10 major and minor forex pairs simultaneously. Instead of betting everything on EURUSD or GBPUSD, the EA spreads opportunities across AUDCAD, NZDCAD, AUDNZD, EURGBP, and other carefully selected pairs.

This diversification approach delivers three critical advantages:

Increased Opportunity Frequency: With multiple pairs active, the EA doesn't wait for perfect setups on a single market. It finds trending opportunities across different currency relationships throughout the trading day.

Risk Distribution: No single currency pair disaster can devastate your account. When EURUSD faces unexpected volatility, AUDNZD might be trending beautifully in the opposite direction.

Reduced Correlation Risk: The EA's pair selection minimizes correlation exposure, ensuring that geopolitical events affecting EUR pairs don't simultaneously crush your entire portfolio.

According to the Bank for International Settlements, daily forex market turnover exceeds $7.5 trillion, with major pairs representing different economic relationships. Dynamic Pips EA leverages this diversity rather than fighting it.

Intelligent Risk Management Framework

Smart money management separates successful prop firm traders from account blowers. Dynamic Pips EA incorporates several protective layers that would make any prop firm ea evaluation team proud:

Group-Based Stop-Loss System: This unique feature closes all trades within a currency group once a predetermined pip-loss threshold is reached. It's like having a circuit breaker that prevents one bad market assumption from cascading into account destruction.

Fixed Stop Loss with Trailing Take Profit: Every single trade launches with predefined stop losses. As trades move favorably, the trailing take profit mechanism automatically locks in gains while allowing profits to run during strong trending moves.

Adaptive Position Sizing: The EA adjusts lot sizes based on current account balance and recent volatility measurements. During calm market periods, position sizes increase slightly. During high-impact news events, the system scales back exposure automatically.

Market Event Filtering: An integrated news filter prevents the EA from opening new positions during scheduled high-impact events that could trigger unpredictable price gaps or extreme volatility spikes.

Customization That Actually Matters

Cookie-cutter expert advisors fail because every trader has different risk tolerance and market experience. Dynamic Pips EA offers deep customization without overwhelming complexity:

Signal Reliability Levels: Choose between Low, Medium, and High reliability settings based on your preference for trade frequency versus accuracy. Conservative traders prefer High reliability for fewer but higher-probability setups.

Trade Direction Control: Limit the EA to long-only, short-only, or both directions based on your market bias or prop firm requirements.

Risk Exposure Management: Set different risk parameters for each currency pair. You might want aggressive exposure on XAUUSD while maintaining conservative settings on exotic pairs.

Gap Logic and Volume Controls: Fine-tune how the EA responds to price gaps and unusual volume spikes, crucial for navigating volatile Asian or European session openings.

This flexibility allows both conservative traders focused on steady growth and aggressive scalpers seeking short-term profits to configure the system according to their unique trading personality.

Setup and Implementation

Getting Dynamic Pips EA operational takes minutes, not hours:

- Download the EA files from your purchase confirmation

- Copy files to your MetaTrader 4 Experts folder

- Restart MT4 and attach the EA to your preferred chart (XAUUSD recommended for optimal signal clarity)

- Load the recommended settings file included with your purchase

- Enable AutoTrading in MT4 to begin automated operation

The EA works best with a minimum account balance of $1000, allowing proper position sizing across multiple currency pairs without over-leveraging individual trades. For prop firm challenges, consider starting with more conservative settings to meet drawdown requirements while building consistent track records.

FXShop24 Purchase Benefits

When you grab Dynamic Pips EA through FXShop24, you're getting more than just the EA files:

- Instant Download: Access your EA immediately after purchase completion

- Money-Back Guarantee: Full refund policy if the EA doesn't meet your expectations

- Crypto Payment Discount: Save extra when paying with cryptocurrency

- Lifetime Updates: Receive all future EA improvements and optimizations

- Professional Support: Direct access to technical support for installation and configuration questions

The Bottom Line Assessment

Dynamic Pips EA MT4 represents a mature approach to automated forex trading that balances aggressive profit potential with meaningful capital protection. The combination of multi-pair diversification, intelligent momentum-based entries, group-based risk management, and extensive customization makes it suitable for traders ranging from beginners testing their first expert advisor mt4 to professionals managing prop firm accounts.

The verified performance record, while exceptional, should be evaluated within the context of your specific market conditions and risk tolerance. What sets this EA apart isn't just its profit potential: it's the systematic approach to portfolio-wide risk management and the flexibility to adapt to different trading styles and capital requirements.

For traders tired of single-pair dependencies and dangerous martingale systems, Dynamic Pips EA offers a refreshing alternative that treats forex trading as a diversified business rather than a high-stakes gamble. The emphasis on customization and portfolio-wide risk control positions it as a robust tool for navigating today's volatile currency markets while building consistent, sustainable trading results.