13

Oct

Can You Turn $100 Into Thousands Trading Forex?

Ever stare at your trading account balance and wonder if that modest $100 could somehow multiply into thousands? You're not alone. Every day, thousands of aspiring traders ask this exact question, dreaming of turning pocket change into life-changing money through forex trading.

The short answer? Yes, it's absolutely possible, but not in the way most people imagine.

The Harsh Reality of Small Account Trading

Trading with $100 puts you in a unique position that demands a completely different mindset than larger accounts. You're not just learning to trade; you're learning to survive with extremely limited capital while building the foundation for future growth.

Most successful traders who've grown small accounts into substantial sums didn't achieve it through explosive overnight gains. Instead, they mastered the art of consistent compounding, turning small, regular profits into exponential growth over time.

Think of it this way: if you could achieve just 10% monthly growth consistently (which is aggressive but achievable), your $100 would become $1,000 in about 24 months. Bump that to 15% monthly, and you're looking at roughly 16 months. The key word here is "consistently."

Money Management: Your Survival Blueprint

With only $100 to work with, traditional money management rules become even more critical. The standard advice of risking only 1-2% per trade means you're putting just $1-2 on the line with each position. This might seem impossibly small, but it's what keeps accounts alive long enough to grow.

Here's where most small account traders go wrong: they risk 10%, 20%, or even 50% per trade, thinking they need big risks to see meaningful returns. This approach typically destroys accounts within weeks.

Instead, focus on micro-lot trading (0.01 lots) and aim for 30-50 pip gains with tight 15-20 pip stop losses. Yes, your profits will be small initially: maybe $3-5 per successful trade: but preservation is everything when you're starting small.

The compounding effect becomes magical when you consistently reinvest these small gains. After 20 successful trades earning $5 each, you've added $100 to your account. Now you can gradually increase position sizes while maintaining the same percentage risk.

Can Automated EAs Transform Your $100?

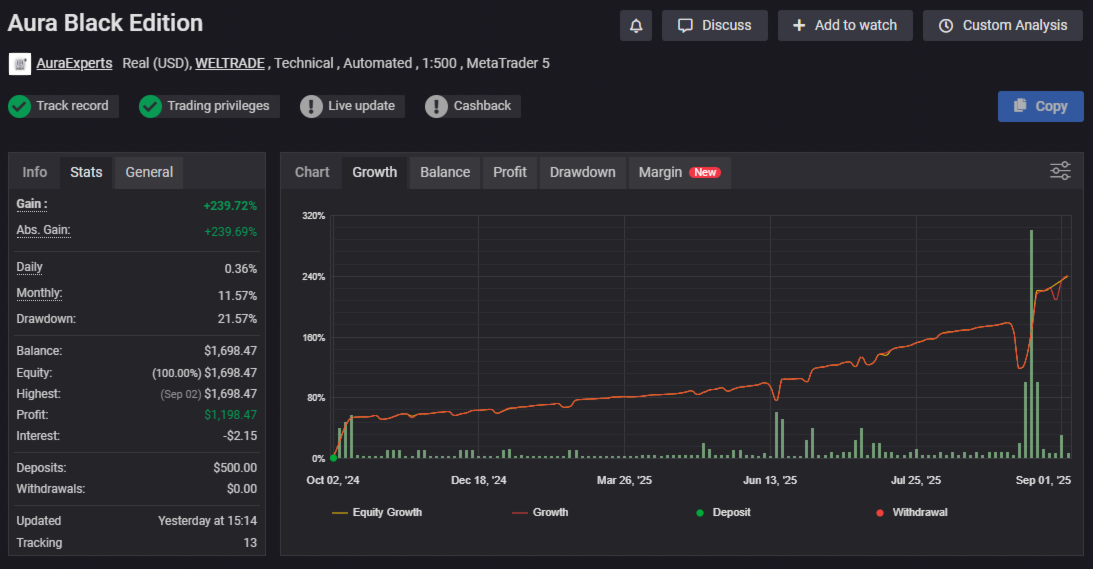

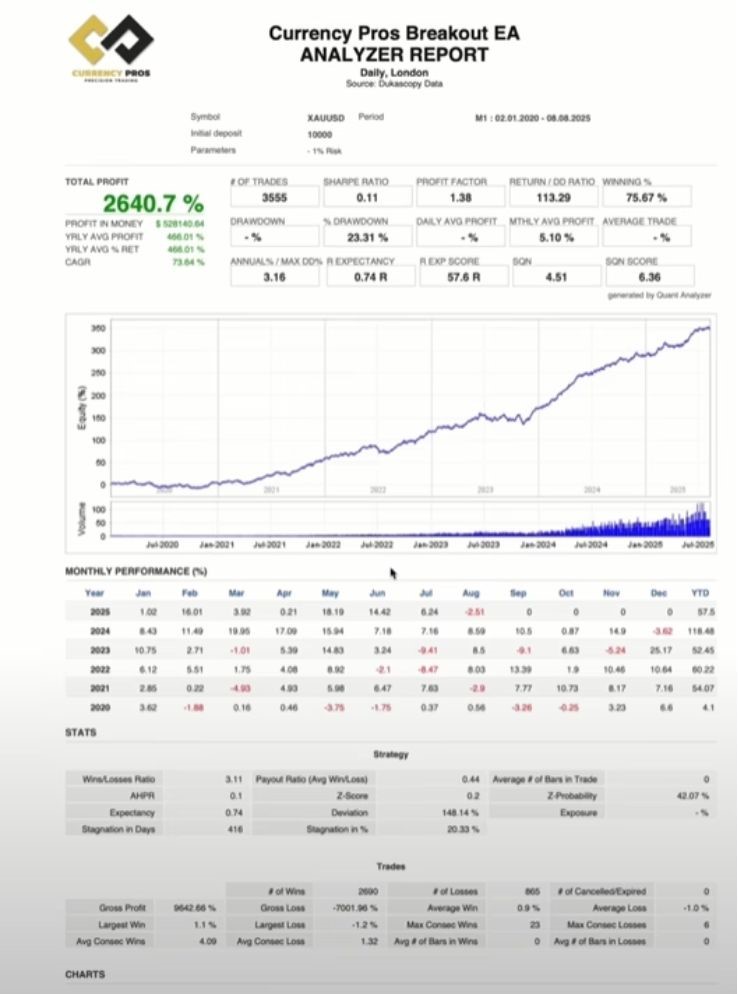

Expert Advisors (EAs) and trading robots have become increasingly sophisticated, and they can indeed help grow small accounts: but only if you choose the right ones and set realistic expectations.

The appeal of automation for small accounts is obvious: EAs don't get emotional, they can trade 24/5, and they execute your strategy without hesitation. However, not all robots are created equal, especially when it comes to small account management.

Look for EAs specifically designed for small account growth. These typically feature:

- Conservative risk settings (1-2% per trade maximum)

- Smart position sizing that adapts to account balance

- Multiple currency pair trading to spread risk

- Built-in drawdown protection

Quality EAs like those available on FXShop24's platform often come with verified track records and money management features specifically tailored for growing small accounts sustainably.

The key is understanding that even the best EA won't turn $100 into $10,000 overnight. Realistic expectations for automated trading with small accounts range from 5-15% monthly growth, assuming optimal market conditions and proper risk management.

The Prop Firm Fast Track

Here's where things get interesting for small account traders: prop firm challenges can be your fastest route from $100 to thousands, but not in the way you might think.

Instead of trying to grow your $100 directly, consider using it as training capital while you prepare for prop firm evaluations. Many prop firms offer challenges starting around $10,000-$25,000 in simulated capital for evaluation fees of $100-$300.

The strategy becomes: use your $100 to master a profitable trading system, then leverage that skill to pass a prop firm evaluation. Once funded, you're trading with $10K, $25K, or even $100K of firm capital while keeping 70-80% of the profits.

This approach requires:

- Consistent profitability with your $100 account for at least 3-6 months

- Strict adherence to risk management rules

- Understanding of prop firm evaluation criteria

- Emotional control under pressure

Several successful traders have used this exact path, turning modest personal accounts into six-figure prop firm allocations within 12-18 months.

Building Your Growth Strategy

The most successful small account growth strategies combine multiple approaches:

Phase 1: Skill Development (Months 1-3) Use your $100 to learn and test strategies without emotional pressure. Focus on achieving consistency rather than big profits. Track your win rate, risk-reward ratios, and emotional responses to losses.

Phase 2: Systematic Growth (Months 4-12) Once consistent, begin compounding gains aggressively. Reinvest all profits and gradually increase position sizes as your account grows. Target 8-12% monthly growth during this phase.

Phase 3: Scale and Diversify (Month 12+) Consider prop firm evaluations, add additional personal capital, or explore other scaling opportunities. By this point, your $100 might have grown to $500-$1,000 through disciplined compounding.

Technology and Tools That Actually Help

Modern trading platforms like MT4 and MT5 offer significant advantages for small account traders. Features like partial position closing, trailing stops, and automated money management can help maximize the efficiency of every trade.

Consider EAs that specialize in small account optimization. These tools often include built-in compounding features, automatic lot size calculations, and risk management protocols designed specifically for growing modest capital.

The U.S. Bureau of Labor Statistics data shows that successful small business owners (which includes traders) typically reinvest 80-90% of early profits back into their ventures: the same principle applies to trading account growth.

Warning Signs and Common Pitfalls

Be wary of strategies or systems promising to turn $100 into $10,000 within weeks or months. These typically involve:

- Excessive leverage (1:500 or higher)

- Martingale or grid strategies without proper safeguards

- High-frequency scalping without considering spread costs

- Emotional trading during news events

The mathematical reality is that turning $100 into $1,000 (a 1000% return) requires either extraordinary risk-taking or extraordinary time and patience. Most successful traders achieve this through the latter.

Your Action Plan Forward

Start with realistic goals: aim to double your account in the first year rather than multiplying it by 10. Focus on developing skills that will serve you whether you're trading $100 or $100,000.

Document everything: track your trades, analyze your mistakes, and celebrate small victories. The lessons learned growing a $100 account will prove invaluable when you're eventually managing larger capital.

Consider your $100 as tuition for the world's most expensive education: trading psychology, risk management, and market analysis. The knowledge gained will be worth far more than the initial investment.

The path from $100 to thousands exists, but it requires patience, discipline, and realistic expectations. Those who succeed treat it as a marathon, not a sprint, building sustainable systems that can eventually handle much larger amounts of capital.

Remember: every professional trader started somewhere. Your $100 beginning could be the foundation of a thriving trading career: if you approach it with the right mindset and realistic timeline.