16

Oct

Automate or Die: Why Successful Forex Traders Rely on EAs and Robots for Consistent Gains in 2025

Ever feel like the market moves against you the moment you place a trade? You're not alone. While you're sleeping, eating, or stuck in meetings, profitable setups slip away. Meanwhile, somewhere across the globe, automated systems are capturing every opportunity with mechanical precision.

Welcome to 2025, where the gap between manual traders and those using Expert Advisors (EAs) has become a canyon. The traders thriving in today's volatile markets aren't necessarily smarter: they've simply embraced automation to handle what human psychology cannot.

The Speed Game You Can't Win

Manual trading in 2025 feels like bringing a knife to a gunfight. EAs operating on MetaTrader 4 and MetaTrader 5 platforms execute orders in milliseconds, responding to price movements faster than any human reaction time allows. When breakouts happen or scalping opportunities emerge, those crucial microseconds determine whether you catch the move or watch it disappear.

Consider this: during NFP releases or major news events, markets can gap 50+ pips in seconds. Your EA processes the price action, checks its criteria, and places the trade before you've even registered what happened on your screen. This isn't about being lazy: it's about competing in a market where speed equals profit.

Breaking the Emotional Trading Cycle

Here's the uncomfortable truth: your emotions are sabotaging your trading account. Fear makes you exit winners too early. Greed keeps you in losers too long. Hope prevents you from following your stop losses. These psychological pitfalls destroy more accounts than poor strategy selection ever could.

EAs don't experience fear when prices spike against their positions. They don't get greedy and move profit targets mid-trade. They execute exactly what you programmed them to do, maintaining the discipline that manual traders struggle to sustain during volatile sessions.

The Bank for International Settlements reports that retail forex traders lose money 70-80% of the time, primarily due to emotional decision-making. EAs eliminate this human factor entirely, following systematic rules regardless of market chaos or personal stress levels.

Never Miss Another Overnight Move

The forex market operates 24/5, but your attention span doesn't. Those Asian session breakouts, European open spikes, and overnight news events happen while you're unavailable. Manual traders miss countless opportunities simply because they can't monitor charts around the clock.

EAs never sleep. They scan multiple currency pairs simultaneously, identifying setups across different time zones and market sessions. Whether it's a 3 AM breakout on GBP/JPY or a pre-market spike in gold, your automated system captures moves that manual trading inevitably misses.

The Multi-Market Advantage

Try monitoring EUR/USD, GBP/JPY, XAUUSD, and US30 simultaneously while analyzing multiple timeframes for each. Your brain will overload within minutes. EAs process unlimited market data streams without cognitive fatigue, executing trades across various instruments based on their individual setups.

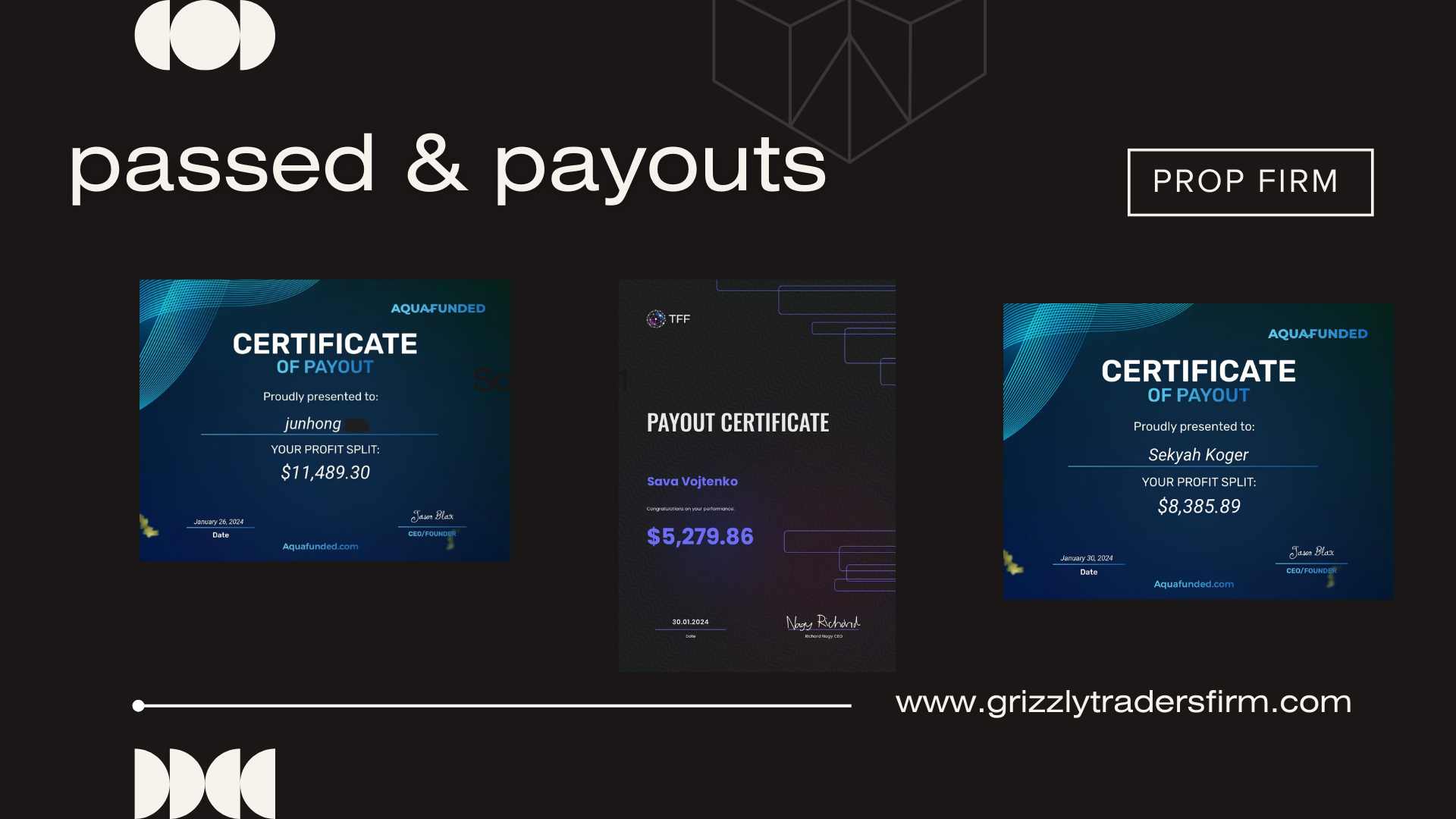

This capability proves especially valuable for prop firm challenges, where traders must demonstrate consistent profitability across multiple trading days. EAs maintain systematic performance standards that human traders struggle to replicate under evaluation pressure.

Prop Firm Success Through Automation

Prop firms evaluate traders on consistency, drawdown control, and profit generation: metrics where EAs excel. Manual traders often fail prop challenges due to emotional mistakes during crucial evaluation periods. One revenge trade or missed stop loss can end a month-long evaluation.

EAs follow predefined risk management rules without deviation. They maintain consistent position sizing, honor stop losses, and avoid the impulsive decisions that destroy prop firm accounts. Many successful prop traders now use semi-automated approaches, letting EAs handle execution while maintaining strategic oversight.

Testing and Validation Capabilities

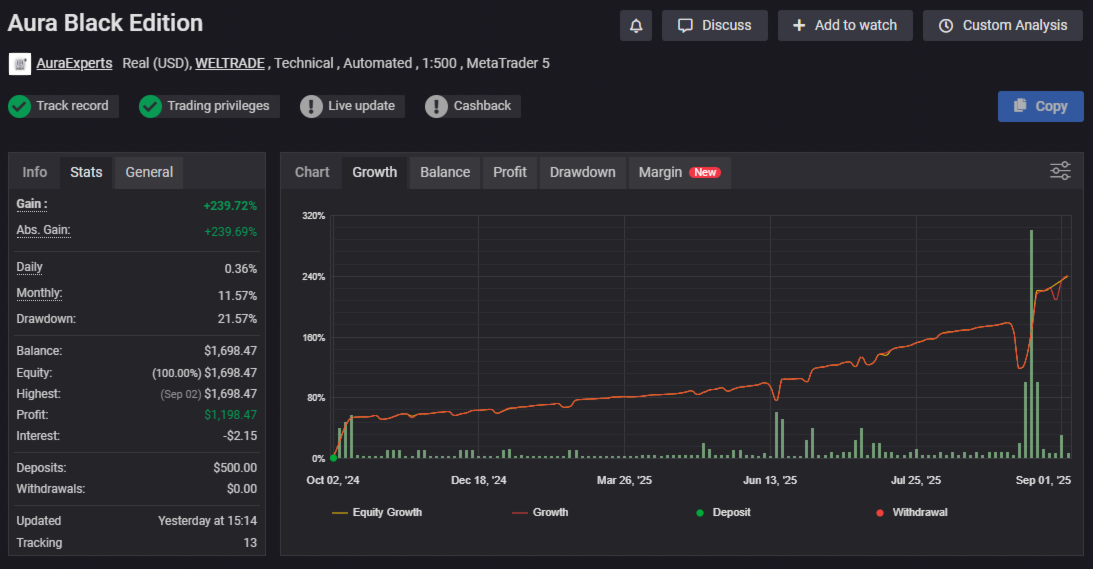

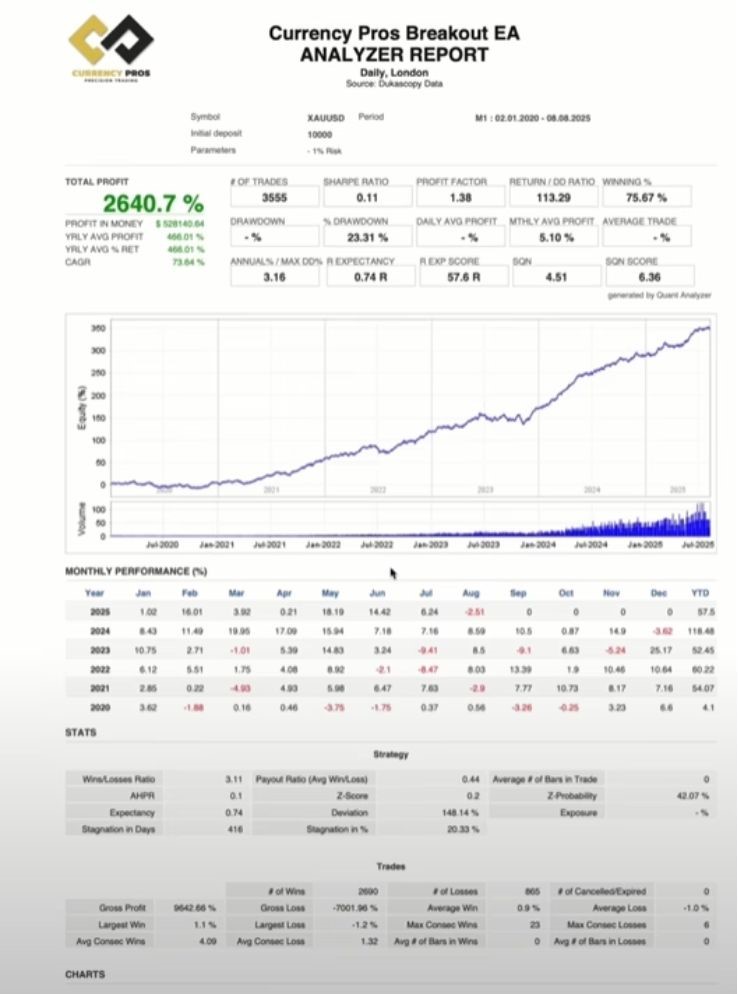

Before risking real capital, EAs can undergo extensive backtesting against years of historical data. You can measure win rates, maximum drawdown, profit factors, and recovery periods across different market conditions. This level of strategy validation is impossible with manual trading approaches.

Forward testing on demo accounts adds another layer of confidence. You can observe how your EA performs in current market conditions without financial risk, fine-tuning parameters before going live. This systematic approach to strategy development separates professional traders from gamblers.

Getting Started with Automation

Begin by identifying your trading style and preferred markets. Scalpers need EAs optimized for tight spreads and fast execution. Swing traders require systems designed for longer holding periods and larger stop losses. Your automation strategy should align with your account size and risk tolerance.

Start with a single currency pair and timeframe. Master one automated approach before expanding to multiple markets. Demo test extensively: at least 30-60 days of live market conditions. Pay attention to how your EA handles news events, weekend gaps, and unusual volatility spikes.

Consider these essential factors when selecting an EA:

Verified Performance Records - Demand independently verified results from third-party tracking services like Myfxbook or FxBlue. Screenshot results mean nothing in 2025.

Transparent Strategy Logic - Understand how your EA makes trading decisions. Black box systems might work temporarily but become worthless when market conditions change.

Active Development Support - Markets evolve constantly. Your EA needs regular updates and optimizations from responsive developers who understand current market dynamics.

Risk Management Features - Look for built-in drawdown limits, daily stop losses, and position sizing controls. These features protect your account during unexpected market events.

The FXShop24 Automation Advantage

At FXShop24, we've seen the transformation firsthand. Traders who embrace quality automation systems consistently outperform their manual counterparts. Our curated selection focuses on EAs with proven track records, transparent strategies, and ongoing support.

Whether you're targeting prop firm challenges or building long-term wealth, automation provides the consistency and discipline that separate successful traders from the majority who struggle with emotional decision-making.

The Golden Pickaxe EA exemplifies this approach, combining multiple strategy elements with robust risk management protocols. Systems like the PerceptrAder AI demonstrate how artificial intelligence enhances traditional trading logic for improved market adaptation.

The 2025 Reality Check

Automation isn't magic. EAs can't predict black swan events or guarantee profits during unprecedented market conditions. However, they provide systematic execution, emotional discipline, and round-the-clock market coverage that manual trading simply cannot match.

The most successful traders in 2025 combine automated execution with human oversight. They use EAs to handle mechanical tasks: order placement, risk management, multi-market monitoring: while maintaining strategic control over portfolio decisions and market analysis.

Your choice is simple: adapt to automated trading or accept the limitations that emotional, time-constrained manual trading imposes. The market doesn't care about your preferences: it rewards those who execute systematically and capitalize on every available opportunity.

The traders thriving in 2025 didn't just learn to use EAs: they learned to think like systems. They developed processes, eliminated emotional interference, and built consistent approaches to market participation. Automation became their competitive advantage in an increasingly sophisticated trading environment.

Start small, test thoroughly, and gradually expand your automated trading systems. The learning curve exists, but the performance improvements make the effort worthwhile. Your future trading success depends on embracing the systematic approaches that EAs provide.