11

Oct

The Ultimate Guide to MT5 Robots: Everything You Need to Succeed in 2025

Ever feel like you're missing profitable trades while you sleep? Or watch the market reverse the moment you step away from your screen? You're not alone. This is exactly why MT5 robots have become the secret weapon of successful traders who want to capture opportunities 24/7 without burning out.

MetaTrader 5 Expert Advisors (EAs) aren't just fancy trading tools: they're your digital trading partners that never get tired, never second-guess a setup, and never let emotions cloud their judgment. In 2025, these automated systems have evolved far beyond simple moving average crossovers into sophisticated AI-powered strategies that adapt to market conditions in real-time.

But here's the thing: not all MT5 robots are created equal. The market is flooded with flashy promises and fake backtests, making it harder than ever to separate the winners from the losers. This guide cuts through the noise and shows you exactly how to identify, deploy, and profit from MT5 robots that actually work.

What Makes MT5 Robots Different from MT4

While MT4 dominated the EA landscape for years, MT5 robots bring significant advantages that smart traders are leveraging right now. MT5's enhanced architecture supports more asset classes beyond forex: you can run the same robot on stocks, commodities, and indices without switching platforms.

The real game-changer is MT5's superior backtesting engine. Unlike MT4's limited historical data, MT5 provides tick-level precision that reveals how your robot would have performed under real market conditions. This means more reliable backtests and fewer nasty surprises when you go live.

MT5 also handles multiple timeframes simultaneously within a single EA. Your robot can monitor the daily trend while executing on 15-minute signals, creating more sophisticated strategies that mirror how professional traders actually analyze markets.

Types of MT5 Robots That Actually Work

The MQL5 Wizard Advantage

Don't overlook MT5's built-in robot creator: the MQL5 Wizard. This tool generates fully functional EAs without writing a single line of code. You simply select your trading signals (RSI, MACD, moving averages), set your risk parameters, and the Wizard creates a working robot ready for testing.

The beauty of the Wizard is transparency. You can see exactly how your robot makes decisions, modify the logic as needed, and combine up to 64 different signals. It's perfect for traders who want custom strategies without hiring a programmer.

AI-Enhanced Robots: The 2025 Revolution

The newest frontier combines traditional technical analysis with artificial intelligence. These robots don't just follow preset rules: they learn from market behavior and adjust their strategies accordingly. Some use machine learning to identify pattern recognition that humans might miss, while others employ neural networks to optimize entry and exit timing.

Trend-Following Systems That Adapt

Modern trend-following robots go beyond simple moving average crossovers. The best ones incorporate multiple confirmation signals, dynamic position sizing based on volatility, and intelligent filtering to avoid whipsaws during sideways markets. Look for robots that can identify when trending conditions are favorable and reduce activity during choppy periods.

Essential Features Every MT5 Robot Must Have

Multi-Timeframe Analysis

Superior MT5 robots analyze multiple timeframes simultaneously. They might use daily charts to determine trend direction, hourly charts for timing entries, and 5-minute charts for precise execution. This multi-layered approach significantly improves win rates compared to single-timeframe systems.

Dynamic Risk Management

The best robots adjust position sizes based on current market volatility and recent performance. If the robot has been winning, it might increase position size slightly. After a series of losses, it reduces risk until performance stabilizes. This adaptive approach protects your account during rough patches while maximizing returns during favorable periods.

Broker Compatibility Testing

Not all robots work well with every broker. The best EAs include built-in compatibility checks that verify spread conditions, execution speed, and slippage tolerance before placing trades. This prevents the common scenario where a robot performs well in backtests but fails with your specific broker.

Technical Setup That Ensures Success

VPS Hosting: Non-Negotiable for Serious Trading

Running MT5 robots on your home computer is asking for trouble. Power outages, internet disruptions, and Windows updates can interrupt your trading at the worst possible moments. A Virtual Private Server (VPS) ensures your robots run 24/7 with minimal latency and maximum reliability.

According to MetaQuotes, professional traders using VPS hosting report 23% better execution speeds and significantly fewer missed opportunities compared to desktop installations.

Account Size and Leverage Considerations

Most profitable MT5 robots require minimum account sizes of $500-$1000 to function properly. Smaller accounts force the robot to take excessive risks or skip trades entirely. The sweet spot for most EAs is $2000-$5000, providing enough flexibility for proper risk management while maintaining reasonable profit potential.

Installation and Testing: The Critical Phase

The Proper Installation Process

Download your EA file (with .ex5 extension for MT5), navigate to File > Open Data Folder in MT5, place the file in MQL5\Experts folder, and restart MT5. The robot should appear in your Navigator window under Expert Advisors.

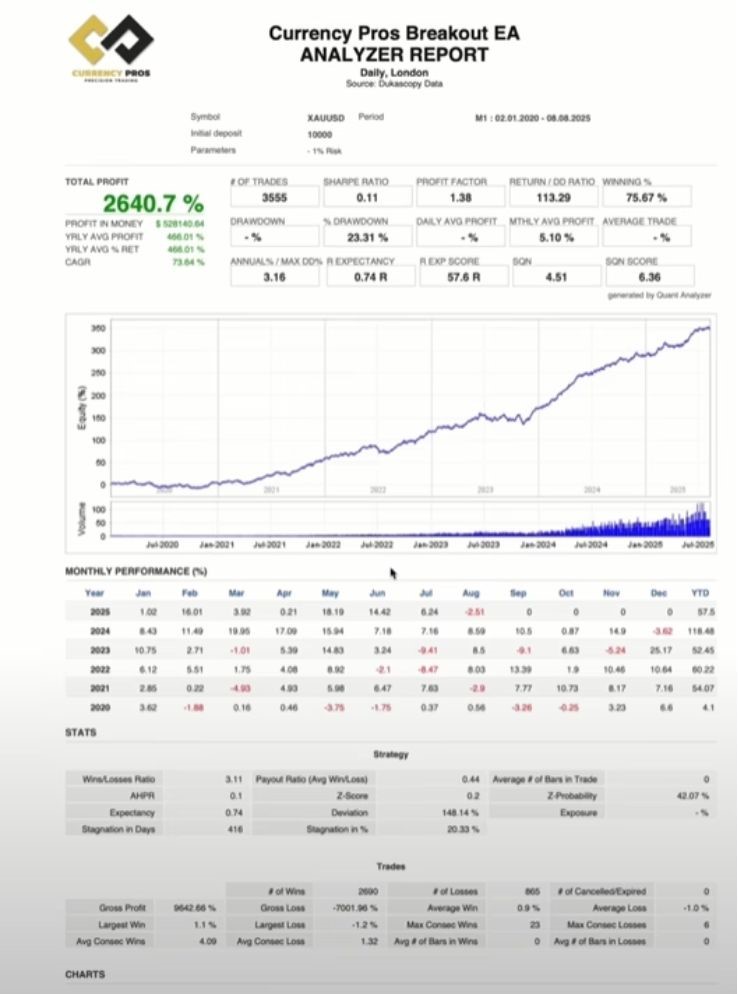

Before going live, spend at least 2-4 weeks testing in the Strategy Tester using quality historical data. Focus on these key metrics: maximum drawdown (should be under 20%), win rate (aim for 60%+ for scalping systems, 40%+ for swing systems), and profit factor (minimum 1.3, ideally above 1.5).

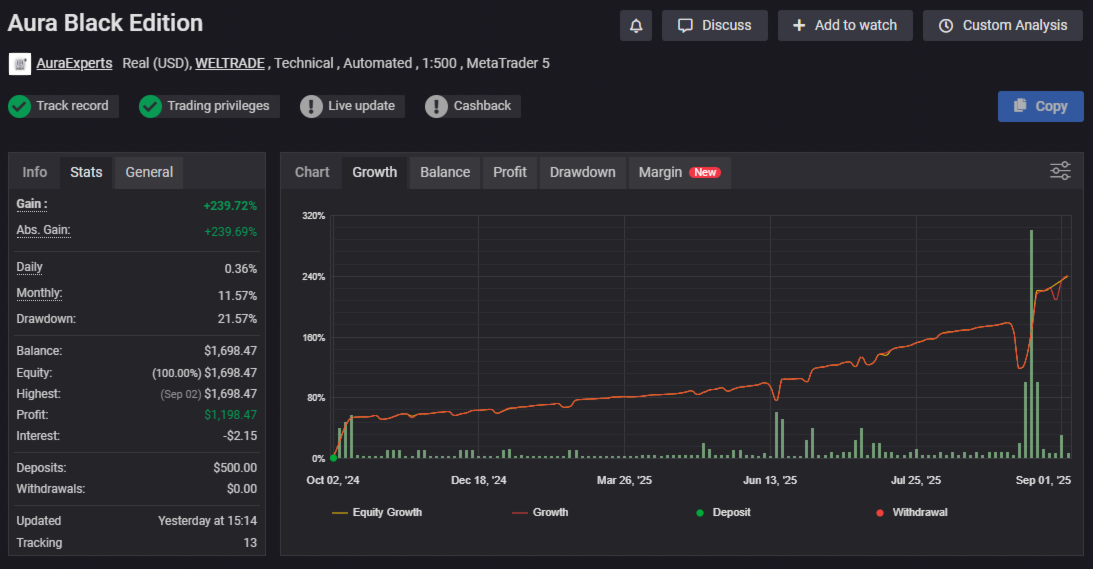

Demo Account Reality Check

Never skip the demo phase. Even robots with stellar backtests can behave differently in live market conditions due to slippage, changing spreads, and execution delays. Run your robot on demo for at least one month, monitoring its performance daily and comparing results to backtest expectations.

The Truth About Profitability

Here's what nobody tells you about MT5 robots: they're tools, not magic money machines. A robot's profitability depends entirely on the strategy it implements and how well you manage it. The best robots typically generate 15-30% annual returns with reasonable drawdowns, not the 1000% monthly gains advertised by scammers.

Focus on consistency over explosive returns. Robots that deliver steady 2-5% monthly gains with low drawdowns will compound your wealth far more effectively than systems promising unrealistic returns that inevitably blow up accounts.

Managing Multiple Robots

Diversification is key to long-term success. Run 3-5 different robots with uncorrelated strategies: perhaps one trend-following system, one range-trading EA, and one news-based robot. This approach smooths out your equity curve and reduces the impact when individual systems hit rough patches.

Advanced Optimization Strategies

Market Condition Filters

The best MT5 robots include market condition filters that adjust behavior based on volatility, news events, and time of day. For example, your robot might trade more aggressively during London-New York overlap when liquidity is highest, and reduce position sizes during Asian sessions when spreads widen.

Correlation Analysis

Advanced robots monitor correlation between currency pairs to avoid overexposure. If your robot typically trades EUR/USD and GBP/USD, it should reduce position sizes when these pairs show high correlation to prevent double exposure to similar market movements.

Common Mistakes That Kill Profits

Over-Optimization Trap

Many traders spend months tweaking robot parameters to maximize backtest results, creating systems that perform perfectly on historical data but fail miserably in live markets. Stick to robust parameters that work across different market conditions rather than curve-fitting to past data.

Ignoring Fundamental Analysis

While robots excel at technical analysis, they can't read economic calendars or assess geopolitical risks. Smart traders pause their robots during major news events like NFP releases or central bank announcements that can cause unpredictable market movements.

Building Your MT5 Robot Portfolio

Start with one proven robot, master its behavior, and understand its strengths and weaknesses before adding others. Focus on systems with verified track records, transparent logic, and ongoing developer support. Avoid robots promising unrealistic returns or those with limited backtesting data.

The most successful automated traders treat their robots like employees: they monitor performance, provide necessary resources (adequate capital, reliable hosting), and make adjustments when market conditions change. With the right approach, MT5 robots can become powerful allies in building consistent trading profits throughout 2025 and beyond.

Remember: the goal isn't to find the perfect robot (it doesn't exist) but to build a diversified portfolio of solid performers that complement each other and align with your risk tolerance and profit objectives.