4

Oct

Has Anyone Else Hit This Wall After Their First Real Loss?

You know that feeling when you're staring at your MT4 platform after watching weeks of profits vanish in a single session? The screen feels different. Your confidence feels shattered. Everything you thought you knew about forex trading suddenly seems questionable.

If you've hit this wall, you're not alone. That emotional barrier after your first real loss is one of the most universally shared experiences in trading: yet it's rarely discussed openly. Today, we're breaking that silence.

The Psychology Behind Your First Real Trading Loss

Your first significant loss doesn't just hurt your account: it rewires your brain. Research from behavioral finance experts shows that losses feel twice as powerful as equivalent gains. When you lose $1,000, it doesn't just feel like missing out on $1,000 in gains: it feels like losing $2,000.

This psychological phenomenon explains why so many traders freeze after their first major drawdown. Your brain's threat detection system goes into overdrive, creating what feels like an impenetrable wall between you and your next trade.

The symptoms are eerily consistent across traders:

- Analysis paralysis: Every setup looks simultaneously perfect and terrible

- Emotional numbness: You feel disconnected from the market action

- Overcompensation: Desperately trying to win back losses with oversized positions

- Identity crisis: "Maybe I'm not cut out for this"

Why Smart Traders Still Hit This Wall

Here's what might surprise you: hitting this wall isn't a sign of weakness or lack of skill. Some of the most successful prop firm traders describe experiencing this exact phenomenon early in their careers.

The wall exists because trading challenges every psychological bias we've developed for survival. Your brain treats financial losses like physical threats, triggering the same stress responses our ancestors felt when facing predators.

Professional traders who've overcome this barrier share three common realizations:

The loss was inevitable: Every trading strategy, including the most sophisticated expert advisor mt4 systems, experiences drawdowns. Your first real loss wasn't a failure: it was tuition paid to the market.

Emotions amplify everything: The loss felt massive because it was your first. Future losses of similar size will feel more manageable as your emotional tolerance builds.

The wall is temporary: This psychological barrier dissolves once you develop proper money management protocols and mental frameworks.

Breaking Through: Practical Solutions That Work

1. Implement Money Management EAs

The fastest way to rebuild confidence is removing discretionary risk management from your trading equation. Money management EAs handle position sizing, stop losses, and risk calculations automatically, eliminating the emotional decision-making that often follows losses.

Consider implementing an EA that:

- Calculates position sizes based on account percentage risk

- Sets automatic stop losses regardless of your emotions

- Prevents revenge trading by limiting daily loss thresholds

2. Start Trading Journal Analysis

Your trading journal becomes your psychological recovery tool. Document not just what happened, but how you felt before, during, and after each trade.

Key journal entries after your first loss:

- What triggered the loss? (News event, overconfidence, poor timing?)

- How did you react emotionally?

- What would you do differently with 20/20 hindsight?

- What did this loss teach you about your trading strategy?

3. Reframe Losses as Data Points

Professional traders view losses differently than retail traders. Instead of seeing your first big loss as failure, treat it as expensive market research.

Ask yourself:

- What market conditions caused this loss?

- How can I adjust my strategy to handle similar conditions?

- What early warning signs did I ignore?

This analytical approach transforms emotional trauma into actionable intelligence for future trades.

Rebuilding Mental Resilience: The Prop Firm Approach

Prop firm traders face unique psychological challenges because they're trading capital that isn't theirs. Their approach to mental resilience offers valuable insights for retail traders recovering from losses.

The 1% Recovery Method

Start by risking only 1% of your account on each trade until you rebuild confidence. This approach:

- Reduces emotional intensity of each trade

- Allows you to take more trades and gather data

- Builds positive momentum through consistent, small wins

- Teaches proper risk management habits

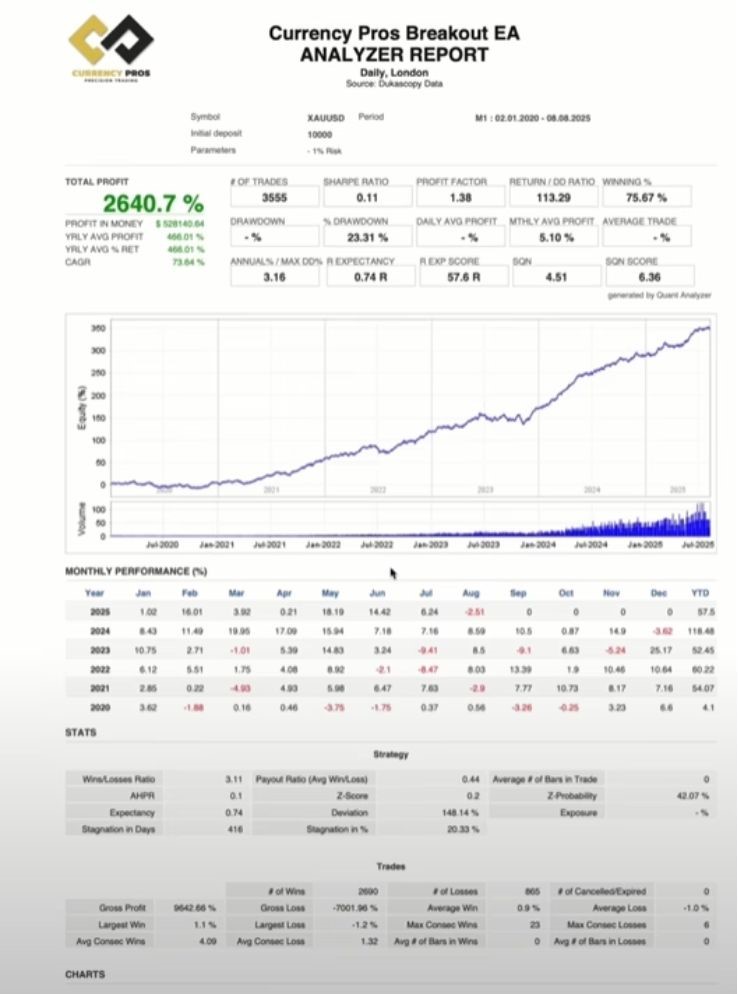

Systematic Strategy Testing

Before risking significant capital again, backtest your trading strategy thoroughly. Use historical data to:

- Identify your strategy's maximum drawdown periods

- Calculate expected win rates and average losses

- Understand normal performance cycles

This preparation mentally inoculates you against future losses because you'll expect them as part of your strategy's normal operation.

The Community Factor: You're Not Trading Alone

One reason the first loss feels so devastating is the isolation. Unlike other professions where colleagues share similar experiences openly, trading losses often feel like personal failures we hide from others.

Connecting with other traders who've experienced similar setbacks provides crucial perspective. Online trading communities, forums, and mentorship groups offer:

- Validation that your experience is normal

- Practical advice from traders who've overcome similar challenges

- Accountability partners for implementing new risk management protocols

- Success stories that prove recovery is possible

Technical Tools for Emotional Recovery

While psychology is crucial, technical tools can accelerate your recovery process:

Expert Advisor Implementation

Expert advisors remove emotional decision-making from your trading process. Consider EAs that:

- Execute trades based on predetermined criteria

- Manage risk automatically

- Prevent impulsive trades during emotional periods

Prop Firm Practice Accounts

Many traders benefit from practicing with prop firm evaluation accounts after a significant loss. These accounts provide:

- Real trading conditions without personal capital risk

- Structured risk management requirements

- Performance metrics to track psychological recovery

Moving Forward: Your Next Steps

Recovery from your first real trading loss isn't about forgetting the experience: it's about integrating the lessons learned into a stronger trading approach.

Your action plan should include:

- Implement automated risk management through money management EAs or position sizing calculators

- Start comprehensive trade journaling focusing on emotional states and decision-making processes

- Reduce position sizes temporarily while rebuilding confidence and refining your strategy

- Connect with other traders who've experienced similar challenges

- Backtest your strategy extensively to understand normal drawdown periods

The wall you've hit after your first real loss isn't permanent: it's a checkpoint. Every successful trader has stood where you're standing now, questioning everything they thought they knew about the markets.

The difference between traders who quit and those who achieve long-term success isn't the absence of losses: it's how they respond to them. Your first real loss just taught you more about trading psychology than months of wins ever could.

Take time to process this experience, implement proper risk management protocols, and remember: the market will be here when you're ready to return. And when you do return, you'll be a stronger, more prepared trader because of what you've learned.

The wall isn't the end of your trading journey: it's the beginning of your evolution into a professional trader who understands that losses are simply part of the business.