2

Oct

Best EA and Algo Strategies for Forex Traders: Riding the October 2025 Trends

Ever watched your trading account swing wildly while gold hits record highs, Bitcoin surges to new peaks, and central banks play monetary policy chess? October 2025 isn't your typical trading month: it's a perfect storm of volatility that's either making fortunes or breaking accounts.

The good news? Expert Advisors and algorithmic strategies are finally catching up to these chaotic market conditions. With algorithmic trading now handling up to 92% of forex transactions, having the right automated approach isn't just an advantage: it's essential survival gear.

Why October 2025 Demands Smarter Automation

This month's market dynamics are unlike anything we've seen recently. Gold and silver are breaking through resistance levels that held for years, Bitcoin's rally is pulling risk sentiment in multiple directions, and EUR/USD volatility is creating opportunities that disappear in minutes.

Traditional set-and-forget EAs are getting crushed. The market is rewarding adaptive systems that can pivot between trend-following and mean reversion modes based on real-time conditions.

Top-Performing EA Strategies for Current Market Chaos

Neural Network Price Forecasting Systems are dominating October's volatile environment. These advanced EAs use hybrid LSTM/CNN models that adapt to changing market patterns in real-time. Unlike traditional indicators that lag, neural networks can achieve up to 96% directional accuracy on minute-level data by learning from current market behavior rather than just historical patterns.

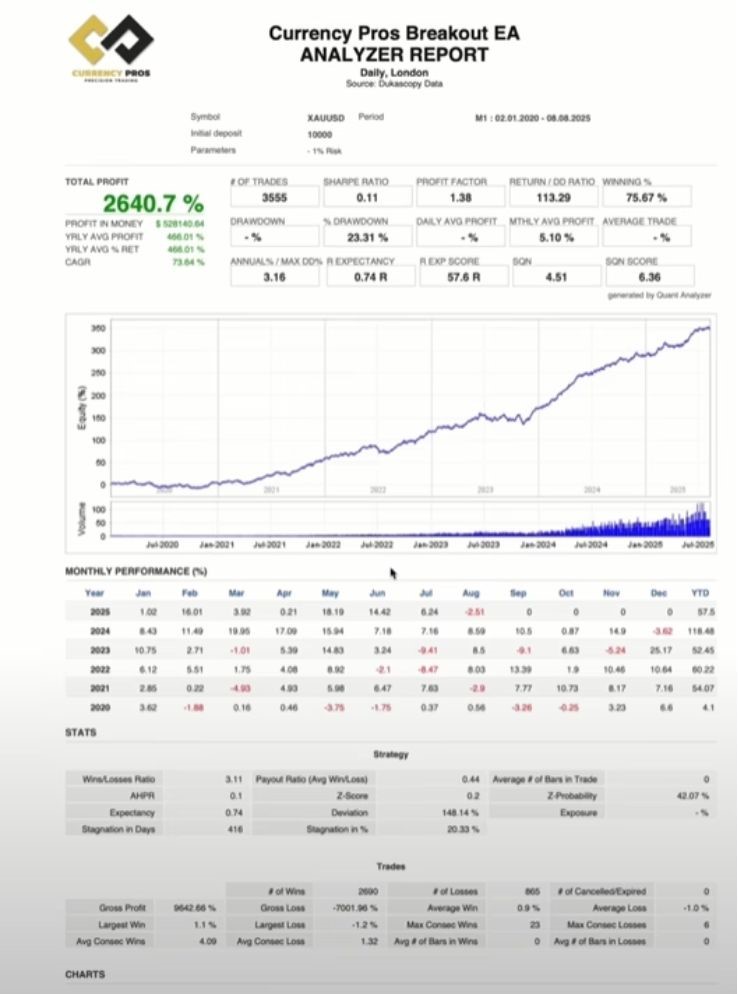

Breakout Momentum EAs are particularly effective during this period of asset breakouts. These systems automatically detect when prices escape key support and resistance zones, confirmed by volume and volatility expansion. With gold and Bitcoin hitting new highs, breakout strategies are capturing significant moves that manual traders often miss.

Multi-Timeframe Trend Following EAs excel in the current environment by analyzing trends across multiple timeframes simultaneously. When a 15-minute trend aligns with a 4-hour trend during a Bitcoin surge or EUR/USD volatility spike, these systems enter with higher confidence and better risk management.

Algorithmic Approaches for High-Volatility Trading

Statistical Arbitrage Engines are thriving in October's divergent asset performance. These algorithms exploit temporary price differences between correlated assets: like when Bitcoin's surge affects currency pairs differently than expected, or when gold's rally creates opportunities in commodity currencies.

Sentiment-Signal Trading Systems convert real-time social media and news sentiment into actionable signals. With Bitcoin hitting headlines and central bank communications moving markets, these algorithms process information faster than any human trader can react.

Low-Latency Market-Making Algorithms provide consistent profits in volatile conditions by offering bid/ask liquidity in microseconds. While individual moves might be small, the frequency of opportunities in October's markets creates substantial cumulative returns.

Adapting EA Settings for Specific Assets Right Now

Gold and Silver EAs need wider stop losses and extended take profit targets to accommodate the current breakout momentum. Reduce position sizing but increase the number of entries to capture the full range of intraday movements. Consider EAs that can handle overnight gaps, as precious metals are moving significantly during off-market hours.

Bitcoin-Correlated Strategies require dynamic correlation monitoring. Bitcoin's surge is affecting traditional forex pairs in unexpected ways. EAs should incorporate real-time correlation adjustments to avoid false signals when crypto sentiment overwhelms traditional currency fundamentals.

EUR/USD Volatility Management demands adaptive position sizing based on ATR (Average True Range) calculations. With central bank policy divergence creating unexpected moves, your EA should automatically adjust position sizes when volatility exceeds historical norms.

Smart Money Management for Uncertain Market Phases

Dynamic Risk Allocation is crucial right now. Instead of fixed lot sizes, implement EAs that calculate position sizes based on current volatility levels. When gold spikes 2% in an hour, your risk per trade should automatically adjust to maintain consistent account risk.

Multi-Level Position Management proves most effective during trending breakouts. This approach places multiple trades at predetermined intervals with increasing size, ensuring that profitable later positions compensate for any initial adverse moves. It's particularly powerful during sustained trending moves like we're seeing in precious metals.

Correlation-Based Portfolio Management prevents overexposure when similar assets move together. Your EA should recognize when gold, silver, and commodity currencies are all trending in the same direction and reduce overall exposure to prevent portfolio concentration risk.

Implementation Strategies for Both Beginners and Pros

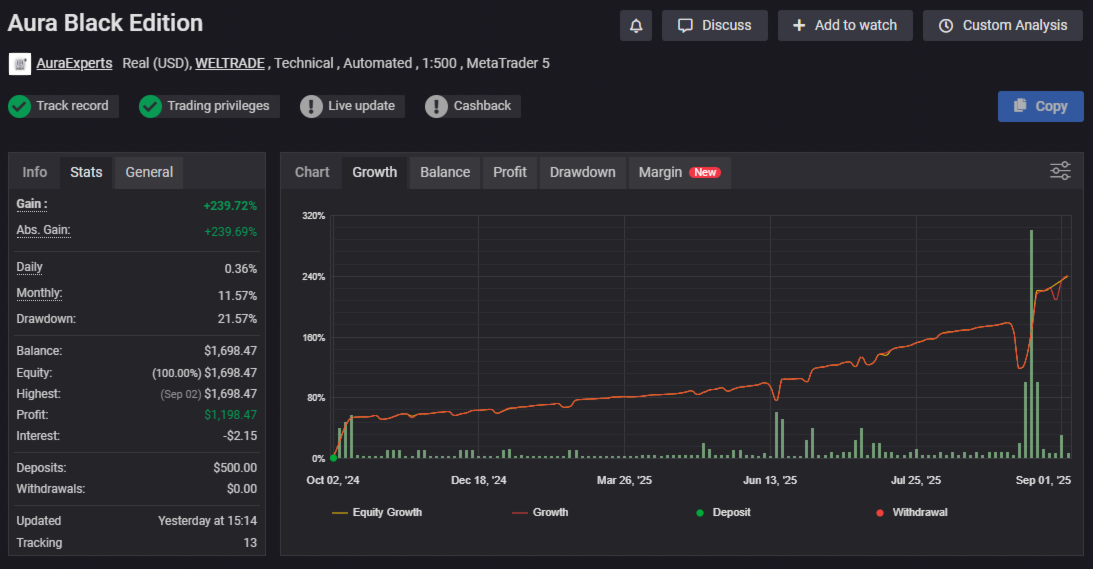

For Beginners: Start with proven trend-following EAs that have clear backtesting results on current market conditions. Focus on major pairs like EUR/USD and GBP/USD where spreads are tight and liquidity is abundant. Use demo accounts to understand how your chosen EA performs during news events and volatile sessions.

For Advanced Traders: Implement hybrid systems that combine multiple algorithmic approaches. Use neural network EAs for trend identification, statistical arbitrage for entry timing, and dynamic risk management for position sizing. Consider running multiple EAs on different timeframes and assets for portfolio diversification.

Risk Management Essentials apply regardless of experience level. Never risk more than 1-2% of your account per EA instance, implement maximum daily loss limits, and ensure your EAs can handle broker disconnections and slippage during volatile periods.

Platform Selection and Optimization

MetaTrader 4 and 5 remain the gold standard for EA implementation, offering robust backtesting capabilities and extensive customization options. Ensure your broker provides fast execution and minimal slippage during volatile sessions: this becomes critical when EAs are making split-second decisions on Bitcoin or gold breakouts.

VPS Hosting is non-negotiable for October's market conditions. Latency differences of even 50-100 milliseconds can mean the difference between catching a breakout and missing it entirely. Choose VPS providers located close to your broker's servers.

Real-Time Monitoring tools help you understand how your EAs are performing during different market sessions. October's volatility means that an EA performing well during London sessions might struggle during New York sessions when different news flows dominate.

Looking Ahead: Preparing for November Transitions

As October's trends evolve, successful algorithmic traders are already preparing for potential market regime changes. The key is running EAs that can adapt to shifting market conditions rather than relying on static strategies optimized for specific environments.

Monitor your EA performance metrics daily, not weekly. In fast-moving markets, a profitable strategy can turn destructive within hours if market conditions change. Keep backup strategies ready and don't hesitate to pause underperforming EAs while market conditions stabilize.

The combination of record-breaking asset prices, central bank policy shifts, and technological advancement creates unique opportunities for traders who embrace adaptive algorithmic strategies. Whether you're running neural network systems or simple breakout EAs, the key is matching your automated approach to October's unprecedented market dynamics.

Your success this month depends not just on having the right EA, but on understanding when and how to deploy it in rapidly changing market conditions.